When it comes to politics, there seems to be little you can know for certain anymore. But one thing all of us can absolutely bank on in the future is that we can safely ignore pollsters. Where do they get these people? Apparently once you have completely failed at every possible occupation, you have officially qualified to be a pollster.

Virtually every day for the six months leading up to the election, national polls indicated that Biden was leading Trump . . . sometimes by a decent margin, sometimes by a large margin. And for two consecutive national elections, they have missed the mark . . . and they have missed it badly.

Whatever you think the ultimate outcome of the presidential election will be, it is safe to say Biden did not win the presidency by a huge margin. When you go to bed on election night and you know who the next president will be….THAT’S a huge margin. And if the Republicans win only one of the Georgia run-off Senate elections in January, they will have maintained control of the U.S. Senate, in addition to having gained meaningful seats in the House. The Blue Wave the pollsters predicted never materialized.

This election was a repudiation of Donald Trump as well as the Democratic Party. The biggest winner here was the moderate voter who did not want to be associated with Trump-antics but who is also turned off by the “progressive,” perhaps even radical, Democratic platform.

For those of you who were convinced President Trump would destroy the economy, it should be noted that the stock market increased 70% from election day to election day.

And for those of you who are convinced President-elect Biden will destroy the economy, it should be noted that the stock market apparently does not share your view. It has already increased over 7% in less than two weeks.

We repeat . . . America is much bigger than who is sitting in the Oval Office.

Case in point:

Since the election, Pfizer announced that they have developed a COVID-19 vaccine that has proven to be 90% effective. And today Moderna has released similarly good results about its vaccine. WOW! A 3-legged hamster could be President of the United States and this would still be spectacular news. The White House resident notwithstanding, this means we can see a light at the

end of the tunnel. We can begin to envision a time where Americans will be flying on airplanes, renting cars, staying in hotels, and going to games and concerts.

The United States government’s coordination with biotech companies to fast-track a vaccine has produced incredible results in a short period of time. This is a real-world example of what can happen when governments help industries instead of getting in their way.

However, saying there is a light at the end of the tunnel implies that we are still in a tunnel.

Having an effective vaccine is one thing. Delivering it to everyone is another. The Pfizer vaccine has to be stored at -70° Celsius, colder than the South Pole. For those of you who have never been to the South Pole, it is really, really, really, really cold. Your average freezer does not meet this specification. Fortunately, the Moderna vaccine is not so “temperature-demanding.”

Complicating things further is the fact that both vaccines require two shots administered several weeks apart.

Even after the logistics of administering the vaccines are worked out, it will take many months (at a minimum) to produce enough doses to be widely available to the general public, domestically and worldwide. And while these vaccines can immunize patients from contracting the virus, researchers are still unsure if these vaccines can prevent patients from spreading the virus to others.

We are optimistic about this news and the prospect for future related medical breakthroughs. But we are NOT out of that tunnel. COVID cases and hospitalizations in the U.S. are currently at their highest levels ever, with new dismal records being set every day.

__________________________________________

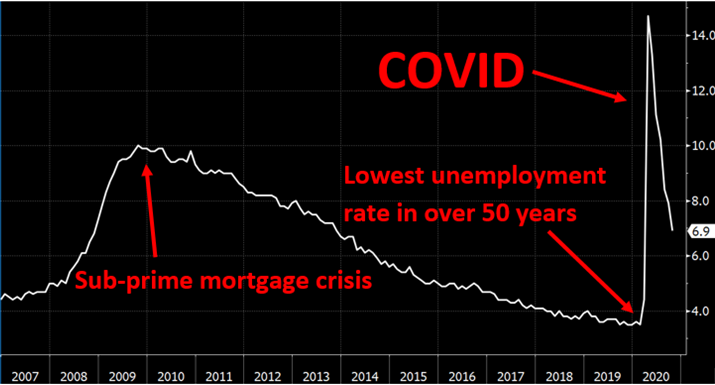

Meanwhile, the economy continues to climb out of the depths of the COVID-induced economic hole created earlier this year. Unemployment numbers keep improving and the rate of people going back to work does not seem to be slowing. We have seen roughly 500,000 people go back to work each week for quite a while. And although the unemployment rate is still at 6.9%, it is actually back to where it was in November 2013 . . . four years after the sub-prime mortgage crisis.

Note, however, that prior to COVID, unemployment in this country was 3.5%, the lowest since the Nixon administration.

Most are aware that the stock market has seemed rather healthy since it hit its “panic” bottom on March 23 (up over 60% since then). At BCWM, we also watch a couple of “fear gauges” — things that tell us that investors are starting to get antsy.

One is the Volatility Index (a.k.a. the VIX). We’ve explained this in the past but all you need to know is that a high VIX is bad and a low VIX is good. And although 23 is not as low as we’d like, it’s a lot better than 80.

Another “fear gauge” we watch is the interest rate on corporate bonds relative to U.S. Treasury bonds, what our industry calls the “credit spread.” When investors anticipate bad times, the spread widens because investors are worried corporations might default on their bonds. When times are better, that spread narrows.

Recently, that spread has almost returned to pre-COVID levels.

The economic improvements over the past few months have led to slightly higher interest rates. The past two months have seen the 10-Year Treasury go from a yield of .67% to .97%. We have not wavered in our view of continuing lower interest rates, and, as of this writing, it is already back down to .89%. Stay tuned.

Remember:

The United States continues to have the strongest economy in the world.

The United States has the most powerful military in the world by far.

The dollar will continue to be the world’s reserve currency for a long, long time.

We have much to be thankful for.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.