This past year was the most difficult investment year in a long, long time. During previous bad markets, there were typically other asset classes (bonds?) that offset the decline in stock prices. For example, during the sub-prime mortgage crisis of late 2007 through early 2009, the stock market declined 55%, but there were other asset classes that INCREASED in value . . . such as gold, which went up 23%, and the bond market, which grew around 7%.

But this past year took no prisoners. There was nowhere to hide, as virtually all asset classes suffered negative returns. (Even gold turned slightly south after rallying the first half of 2022.) Stocks were down over 18% and bonds were no help at all this time, declining double digits.

And, of course, if you ignored our advice and bought cryptocurrencies, your losses may never be recovered.

In addition to being a tough investment year, it was also the culmination of three years of the most absurd investment scams/false hopes/delusions/ self-deceptions/fever dreams in investment history.

As a reminder, 2001 gave us the dot-com bubble, a group of stocks that were purchased so frivolously that, after peaking March 10, 2000, they declined 78% over the next year and a half.

Then 2008 gave us the housing bubble, where prices rose so fast it spawned television shows dedicated to “flipping” houses . . . with people buying homes and selling them in the same month.

But the past three pandemic years gave us a smorgasbord of absurd investment arenas. Not just one or two but at least four.

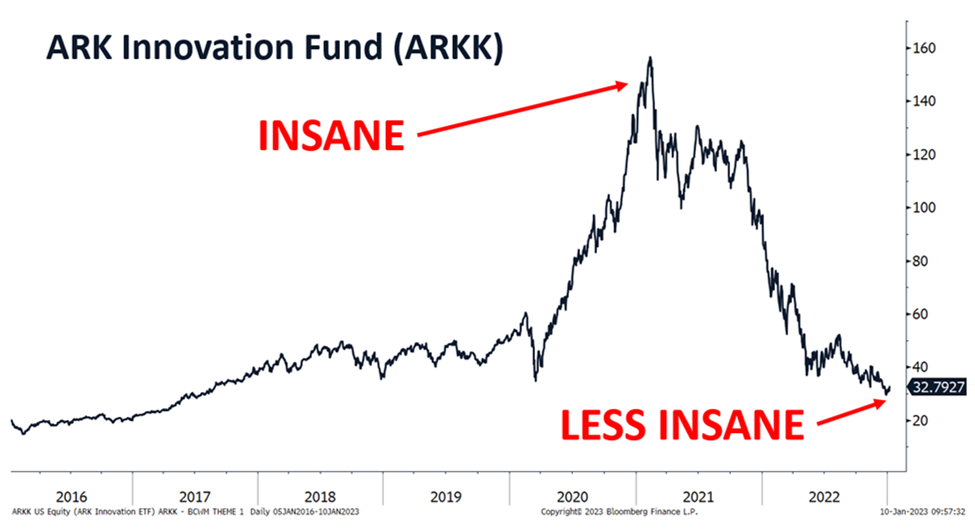

First, there were the “innovation, stay-at-home” technology stocks (this period’s version of the dot-coms). The best proxy for those stocks is the ARK Innovation Fund, which, after climbing from $44 to $156 in a little over a year, has declined 80% since its peak in February 2021.

Then there were the “Meme” stocks. This was a small group of stocks that became the (positive) target of amateur day-traders who turned to the stock markets to gamble when sports betting disappeared during the COVID lockdowns. A few of those stocks tripled/quadrupled/quintupled in a matter of weeks and then (of course) collapsed (what else?).

And riding high through all this were the cryptocurrencies. If you have been paying any attention to us at all, you know that we have never been enamored with the crypto world. We have always said buying cryptocurrencies is like gambling in Las Vegas. Turns out we were wrong. Your odds are MUCH better in Vegas (AND you get free drinks!).

The poster child of the crypto world was Bitcoin, but there were hundreds of others.

The whole crypto world came crashing down a few months ago when a major crypto exchange, FTX, filed for bankruptcy because . . . well, because the owners had absconded with hundreds of millions of dollars/cryptocurrencies/whatever for their own personal use.

Bernie Madoff redux. (See MADOFF: The Monster of Wall Street on Netflix).

Lastly, there was this other thing called SPACs (Special Purpose Acquisition Corporations). We won’t go into a tedious explanation of SPACs, but their time has come and gone, just like the others.

Oh, there’s actually one more . . . maybe the most ridiculous of all. They are called NFTs, which stands for Non-Fungible Tokens. In the most absurd “The Emperor Is Wearing No Clothes” fashion, NFTs are digital works of art saved on a computer chip . . . for which a few morons were paying millions of dollars . . . for a while . . . until they discovered that virtually anyone could make an exact, indistinguishable copy for free. The dumbest idea in a period of incredibly dumb ideas.

Fueling these booms was the $5 trillion in stimulus payments handed out by the United States government.

But that period is winding down and it’s back to investing basics, something we never abandoned at BCWM.

What do we see for 2023?

We continue to believe that inflation peaked last June at 9.1% and that inflation, as a news item, will leave the headlines as the rate of inflation declines month after month. With falling inflation, we foresee interest rates (slowly) declining. Interest rates peaked on October 24, and we feel bonds represent the best risk/reward profile in the investment world today.

Economic slowdown will continue, but that doesn’t necessarily translate into a bad stock market. It’s unusual to experience two consecutive years of ugly stock markets. However, we haven’t forgotten that the 1930s was a difficult investment decade.

Also, we are keenly aware that stock markets “climb a wall of worry.” If everyone you know thinks the stock market is going to crash, you should be fully invested. “Everyone” is almost always wrong.

And in an apparent move of contradiction, we have made a small investment in a China ETF (Exchange Traded Fund) for our clients. Regular readers know that our long-term outlook for China is grim. But the dirt-cheap price of this ETF made it an attractive medium-term investment for our portfolios.

Have a wonderful 2023.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.