Just as the markets were bracing for the next chapter in the tariff saga, the courts pressed the PAUSE button. Yesterday, the U.S. Court of International Trade ruled that Congress, not the president, has the constitutional authority to regulate commerce with foreign nations.

Basically, the court said these tariffs are not a matter of national security. And they have a point . . . charging Nike to import sneakers produced in Vietnam probably does not require emergency action. But, industry-specific tariffs, like those on steel and autos, remain in place because they were imposed under a different trade rule.

This ruling invalidates the majority of the Trump Administration’s tariffs and leaves his trade strategy in legal limbo. The White House has already begun the appeals process, one that could eventually reach the Supreme Court.

Markets are responding positively today. But this story is far from over.

______________

Most Americans, regardless of political affiliation, agree on one thing: the national debt, now approaching $37 trillion, is a problem . . . a problem that has been created by virtually every administration since Clinton, the last president to balance the budget.

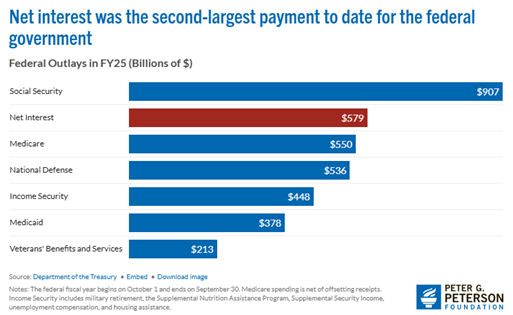

That shared concern has only intensified as the cost of carrying the debt climbs, driven by the sheer size of the debt itself as well as rising interest rates. In 2024, for the first time in history, the U.S. government spent more on interest payments than on national defense. Debt is no longer just a long-term concern; it’s a short-term budget item crowding out other priorities.

Think of it this way: we’re shelling out more to service yesterday’s spending than we are to secure tomorrow’s safety. That reality is starting to shift how markets think about the sustainability of our fiscal path.

So, when the House passed what’s been dubbed the “One Big Beautiful Bill,” many were disappointed it didn’t take a more serious step toward reining in spending. The bill was introduced with the intent to simplify the tax code, support working families, and restore strength at the borders. But it also comes with a hefty price tag. The bill locks in the 2017 tax cuts, adds a few new deductions (car interest, anyone?), boosts the child tax credit, increases defense and border security spending—and raises the debt ceiling by $4 trillion. According to the nonpartisan Congressional Budget Office, the result is an estimated $3.8 trillion added to the deficit over the next ten years.

Elon Musk, who led the Department of Government Efficiency (DOGE), expressed disappointment with the bill, stating that it increases the budget deficit and undermines the work that the DOGE team is doing. He remarked, “I think a bill can be big or it could be beautiful. But I don’t know if it could be both.”

Musk had pitched a bold plan to trim $2 trillion from federal budgets through his work at DOGE, but according to the department website, it has so far found only $175 billion in potential savings.

And while some of those savings are legitimate, many are small in scale or still theoretical, requiring Congressional approval to become permanent. One example that drew rare bipartisan approval? DOGE found that the federal government is paying over $120,000 a year to lease a USDA office in Topeka, Kansas . . . an office that has sat vacant for three years (makes one wonder how many other offices are sitting vacant). Ending that lease will save nearly $1 million. A worthwhile cut, to be sure, but in the context of a $6 trillion budget, it’s a rounding error.

With the U.S. running large deficits and spending more just to pay interest on its debt, the dollar has come under some pressure lately. That’s caught the attention of global investors . . . and European leaders. In a recent speech, European Central Bank President Christine Lagarde made it clear: Europe sees America’s fiscal mess as its opportunity. She pitched the euro as a more stable alternative to the dollar and pointed to things such as U.S. political uncertainty and tariff threats as reasons other countries might want a backup currency.

But here’s the thing: the euro might talk a big game, but it’s still not ready to take the lead. Europe has its own challenges: divided governments, slow reforms, and hesitation about sharing financial risks across countries. So, while the dollar might not be looking its best right now, it’s still in better shape than anything else out there. Currencies are always judged in comparison to one another, and for now, the dollar remains the best athlete on the B team.

The Big Beautiful Bill now heads to the Senate, where it faces a tougher climb. Several senators (on both sides of the aisle) have expressed concerns about the scale of new spending and the lack of meaningful offsets. Whether the bill emerges intact, gets trimmed down, or stalls altogether remains to be seen. But in the meantime, the fiscal picture has already drawn new scrutiny from credit-rating agencies.

This past month, Moody’s (one of the three main credit-rating agencies) reduced its credit rating on U.S. government debt, dropping it from Aaa (their highest rating) to Aa1 (their second highest). This might sound dramatic, but it’s mostly a symbolic slap on the wrist—not a sign of imminent collapse. And, quite frankly, Moody’s is merely catching up with the other two major agencies: S&P dropped the U.S. rating in 2011, and Fitch followed in 2023.

When Fitch made its move, we wrote:

Recently, Fitch, one of the three big credit-rating agencies, downgraded the debt of the United States from AAA to AA+. Fitch’s reasoning boils down to high and growing levels of government debt and an increasingly dysfunctional government.

There are several things to point out about this downgrade. First, the downgrade means very little. There is virtually no chance our government won’t be able to pay its debts. It has the ability to generate tax revenue from the largest and most robust economy in the world.

Furthermore, it should be noted that a rating of AA+ is still a really, really, really, really good rating. It strongly implies that the issuer of the debt will never have any problems paying you back. Changing the letter “A” to a “+” certainly makes a statement, but nothing more.

This latest downgrade by Moody’s doesn’t change the underlying reality: U.S. Treasury bonds remain the most sought-after “safe haven” in the world. Investors aren’t ditching the dollar, and no one’s racing to replace Treasury bonds with Venezuelan bonds or Bitcoin. The move is a reminder that our fiscal house could use some tidying—but it’s not a foreclosure notice.

Needless to say, the headlines about our growing national debt and the threat of tariffs have impacted markets over the last couple months.

Stocks declined sharply the week of “Liberation Day,” only to fully recover and go even higher after the extreme tariff rates were walked backed or paused. At BCWM, we saw this volatility as an opportunity, stepping in to buy stocks at cheaper prices. And after the latest court ruling and subsequent market recovery, those actions have turned out to be quite profitable.

Interest rates have moved higher. The 10-year U.S. Treasury rate is 4.4%, up from 4.2% before the tariff and Big Beautiful Bill news. Recently, this has put pressure on bond prices, but take a step back and look at the bigger picture. The bond market is off to a nice start this year, returning about 2% (Bloomberg U.S. Aggregate Index), beating the stock-market, which is slightly positive.

So where does this leave investors? The economy still looks solid in the rearview mirror, and it’s entirely possible that momentum continues. But looking ahead, uncertainty looms large . . . from unresolved fiscal policy and legal battles over trade to the Fed’s delicate balancing act on inflation and growth. With that in mind, we’ve taken the opportunity to modestly reduce risk in both our stock and bond portfolios and raise a bit of cash. As always, we’re balancing opportunity with caution, guided by long-term discipline, not short-term noise.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.