As we expected, Barack Obama was elected President of the United States by an overwhelming majority. Obama garnered 365 electoral votes and 53% of the popular vote. In all my adult years of sitting up watching election returns, I don’t ever recall the winner being announced as early as 10pm (CST). In addition, the Democrats picked up many new seats in the Senate and the House of Representatives. Clearly the majority of America is not very happy with the current administration. Voters everywhere cast ballots in favor of “change”. And Barack Obama campaigned strongly on the message of change.

In our opinion, Obama did a great job of connecting with younger voters, using the internet extensively throughout his campaign. He did a much better job of convincing the lower income and middle income American that economic conditions would improve if he was elected. His choice of Joe Biden was a “safe” selection and his advisors seemed to never lose their focus.

It will be interesting to see how Obama deals with an economy that has issues which seem to have come together in a “perfect storm”.

- The jobless rate is at 6.5% and likely to rise.

- The U.S. cut 240,000 jobs in October, the 10th consecutive monthly decline in payrolls.

- Home prices in 20 major cities have declined at the fastest pace on record. They have declined in value every month since January, 2007 according to S&P/Case-Shiller.

- Home foreclosures in October increased 25% from October, 2007.

- The Eurozone reported their 2nd quarter of negative growth, indicating Europe is experiencing a recession.

- Japan’s economy has slowed dramatically.

- The National Bureau of Economic Research declared today that the U.S. has been in a recession since December, 2007.

- Many retailers are declaring bankruptcy (Circuit City, Sharper Image, Linens-N-Things and Mervyn’s to name a few) and many others are closing over 100 stores (Foot Locker, Ann Taylor, Zales to name a few).

The Obama administration will not have any effective, quick answers because they don’t exist. All Obama can attempt to do is not make it worse and not make it last longer than it should. One of his first major dilemmas will be dealing with General Motors, Ford and Chrysler. He won’t want to anger all those autoworkers by denying a Federal bailout of the auto industry. As a matter of fact, while Obama is still the “President Elect”, he has declared he wants $50 billion of Federal Aid to help the auto industry. However, he has a golden opportunity…..he has the opportunity to make a great decision early in his term which will anger many American voters (and please quite a few at the same time). By denying aid to the auto industry, he will ultimately strengthen that industry which has been operating inefficiently for over 10 years. By the time he is up for re-election, the auto industry will be on the mend, the economy should be improving and he could end up looking brilliant. Whenever a President has to anger voters by making a difficult decision, he/she should always do it as early in the term as possible.

It was just 6 months ago that oil traded for over $140 per barrel and the American consumer was forced to pay over $4.00 per gallon for gasoline. At the end of November, oil was trading for $54.43 per barrel (and I paid less than $1.40 per gallon yesterday). Other basic commodities have declined in price as well (wheat and corn in particular). This is all very good news for the consumer who will now have more discretionary income to spend on goods and services.

The bad news is that one of the reasons commodity prices have fallen so dramatically is that we are experiencing the worst worldwide recession in 80 years. The Federal Reserve is now concerned with “deflation”. Deflation is a period of declining asset prices (the opposite of inflation). The Fed has many weapons to fight inflation. They have very few weapons to fight deflation. In a period of deflation, consumers curb spending because they feel prices will be lower in the future. One of my daughters just told me last night that she didn’t purchase a dress because she thinks it will be cheaper soon.

A deflationary environment is not good, even if the prospect of buying things at cheaper prices sounds good to you. In the early 1990’s, Japan was faced with falling real estate prices, bank failures and a decision by the government to prop up industries that were not being run well (sound familiar?). As a result, Japan went through a 10 year period of deflation and slow growth while other developed nations were growing every year. In November, the ultimate disposition of Citigroup came into question.

Citigroup, which traded as high as $48.32 per share in October, 2007 and $13.65 at the end of this October, fell to $3.77 on November 21st. This is the same company which was allegedly healthy enough to absorb Wachovia two months ago. The Treasury announced they would inject capital of

$20 billion into Citigroup, avoiding a large (and embarrassing) bank failure.

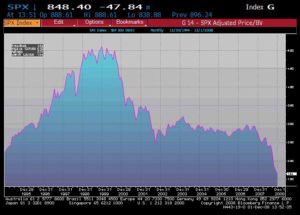

Stock indexes were all down for the month but rallied on the last 5 consecutive trading days to ease the pain. The Dow Jones Industrial Average fell as much as 16.9% but finished -5.3%. The S&P 500 was down 19.1% but finished -7.5%. The EAFE Index was similar. Stock prices are beginning to look cheap on a historical basis. Below is a 15 year chart of the S&P 500 relative to book value. This DOES NOT mean stock prices won’t go lower. In a deflationary environment, the book values of companies might be overstated and could decline. Nevertheless, you can see that prices are the cheapest (relative to book value) in 15 years.

What continues to be the cloud over this economy is the large number of new home foreclosures each month. Fannie Mae and Freddie Mac have temporarily suspended foreclosures and evictions until January 9th. That suspension combined with the recent drop in mortgage rates might make it possible for some homeowners to refinance and avoid foreclosure. We are not optimistic this will be effective enough to remedy the problem. As real estate prices continue to decline, it becomes more difficult for people to refinance.

While the mortgage and banking crisis continues, we fear the next wave of financial problems will stem from commercial loans. Retail corporations filing for bankruptcy and closing stores will undoubtedly put more strain on lending institutions, many of which are already reeling from bad mortgage debt. We said a couple months ago we thought this would be the worst holiday shopping season in our adult lives.

Boyer & Corporon Wealth Management continues to have larger than normal allocations to cash and fixed income. Yields on corporate bonds and municipal bonds look relatively attractive as the “flight to quality” has pushed the yields on Treasury Bonds to very low levels. New equity investments will focus on companies with strong balance sheets and attractive annual dividends. Even though the markets rallied the last five days of November, as I am writing this on the first day of December the

Dow Jones Industrial Average has declined 679 points. We don’t think there is any reason to hurry into stocks.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.