Late last year, a slew of worrisome economic data suggested that a recession was right around the corner. And suddenly EVERYONE was bracing for a downturn in the economy. Many were calling it the most anticipated recession of all time.

At BCWM, we were also on recession watch. The same troubling data had us concerned. However, we also pointed out some reasons for optimism. Ironically, our primary argument was that everyone else was so pessimistic. In February, we wrote:

Perhaps the biggest reason why we might not have a recession is because everyone expects we are heading into a recession. And one thing we have learned about economies and investments is that when EVERYONE expects things are going in one direction, there is a high likelihood they will go in another.

Whad’ya know? Nine months into the year and no recession. Not only that, the consensus seems to have flipped. Today, we read a lot about how the Fed is going to engineer the sacred “soft-landing,” where it will be able to slow the economy just enough to tame inflation while avoiding a recession.

And there is some data to back that up.

- For starters, the labor market continues to remain strong. More jobs are created each month, wages have been outpacing inflation, and the labor-force participation rate (the percentage of the population that wants to work) is the highest it’s been since the pandemic struck.

- Also, after the red-hot housing market started sputtering late last year, it has made a remarkable turnaround. Faced with record-low home affordability (high mortgage rates + high house prices = high mortgage payments), buyers are still showing up. This is a great sign for economic growth.

While the economy is doing okay, we remain cautious. Here’s why:

If we needed only one reason, it might be that everyone else has let down their guard. The consensus that the Fed can engineer a soft-landing is a dangerous one.

Using history as a guide, it is unrealistic to assume the aggressive actions taken by the Federal Reserve will not have side effects. Has everyone forgotten that the Fed’s actions don’t affect the economy instantaneously? When the Fed starts raising interest rates, recessions almost always follow . . . but with a lag. Typically, the lag is around two to three years from when the Fed starts raising rates, and today we’re about 1.5 years in. The rate hikes have been so dramatic (the fastest in 40 years), it’s reasonable to expect that a slowdown is on the horizon.

In addition, we foresee some challenges ahead as the last of the pandemic-era stimulus finally peters out.

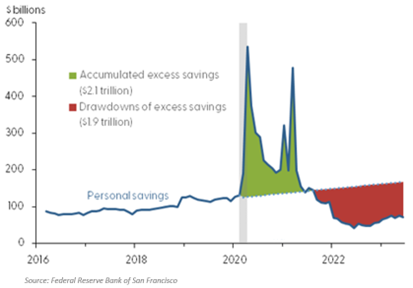

Many Americans stashed a lot of their stimulus checks into savings. The graph below, compiled by the San Francisco Federal Reserve, shows how these “excess savings” (in green) accumulated while people were stuck in their homes. As a country, we amassed $2.1 trillion (yes trillion) in excess savings. Then, the spending spree started, and those excess savings were spent . . . and spent . . . and spent. The drawdown on those savings (in red) was $1.9 trillion (yes trillion) as of June 2023, and those excess dollars are expected to be depleted by the end of this month.

At the same time, credit-card balances have crept back up to their pre-COVID levels.

And for the trifecta, one of the last remnants of COVID-era stimulus ends this month. In October, student-loan borrowers must begin repaying their debt for the first time in three and a half years.

The consumer (the powerhouse of our economy) has been just fine, but for the aforementioned reasons, we could be nearing an inflection point where we start to see signs of weakness.

And, oh, yeah . . . speaking of weakness, let’s not forget about trouble brewing in the world’s second-largest economy, China. The U.S. economy is as big, diverse, and resilient as it gets, but it will not be completely insulated if a Chinese slowdown reverberates throughout the world.

Faced with debt and demographic problems, the outlook for economic growth in China isn’t great. Whereas the rest of the world is still fighting inflation, China is facing deflation and has been cutting interest rates to stimulate the economy.

In July, youth unemployment in China hit an all-time high, over 20%. It’s become so bad that, to save face, the government stopped releasing the data.

Mounting issues in the Chinese real estate market add more worry. One of the country’s top developers, Evergrande, declared bankruptcy last month, and another, Country Garden, just narrowly made good on its debt payment. The property sector accounts for a quarter of the Chinese economy, so this is something to watch.

In the face of global uncertainties and consumer headwinds, we continue to maintain a defensive asset allocation. The Fed is optimistic it can steer us away from a recession, but we’re not drinking the Kool-Aid. It was just six months ago that the government had to put a Band-Aid on the banking system. Our focus is on assets that generate substantial cash flow to shareholders, because these prove to be better at weathering turbulence and economic downturns.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.