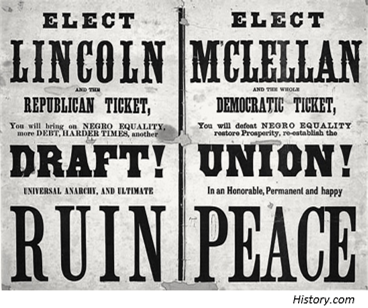

Only 18 more days until our country experiences the most contentious election in over 150 years. The election of 1864 might have been a tad bit more contentious . . .

. . . but the Trump/Biden election seems to be right up there.

A couple of weeks ago we hosted a private webinar for the clients of BCWM. During it, we noted that this COVID recession differs in a few remarkable ways from past typical recessions.

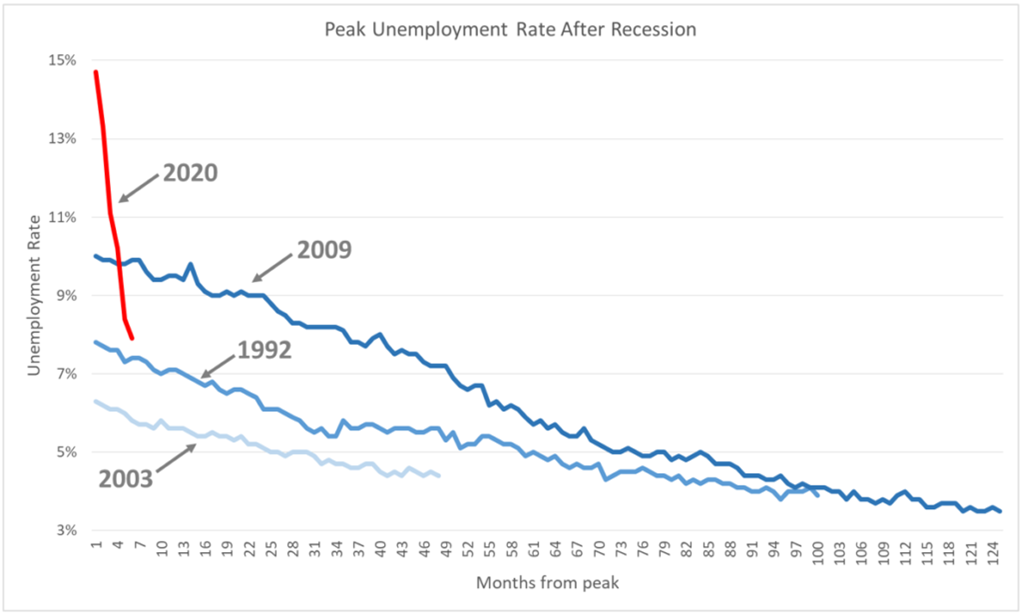

First, unemployment immediately skyrocketed to over 14% and was then nearly halved in just five months. Previous recessions experienced lower levels of peak unemployment but also much slower rates of recovery.

And although the quick drop in unemployment has been impressive, our guess is that the decrease in unemployment from this point forward will follow the path of those previous recessions.

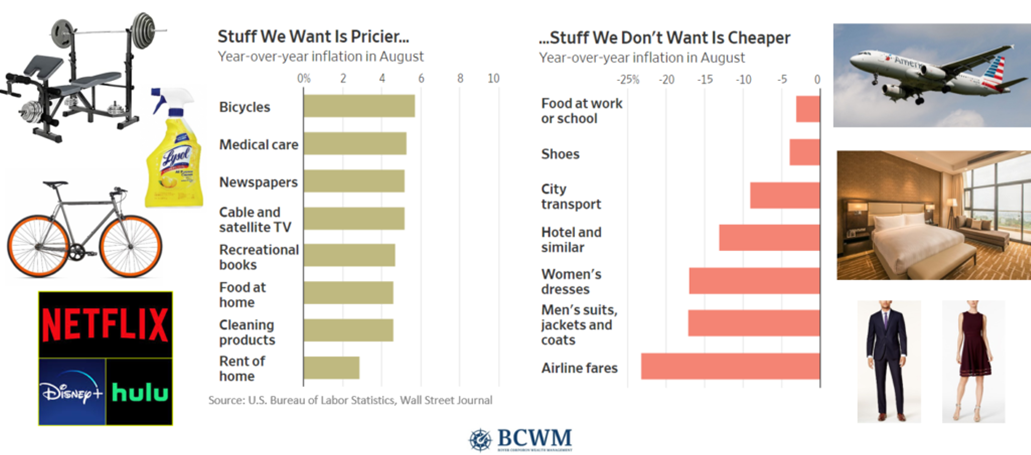

Another stark difference: In other recessions pretty much all areas of the economy were negatively affected. Not so much the case with this one. While demand for many goods and services almost disappeared (airlines, hotels, restaurants, etc.), demand for other goods and services actually increased (video conferencing, exercise equipment, cleaning supplies, etc.). And the prices of those items changed accordingly, proving that the laws of supply and demand still apply.

Another unusual and extreme side effect of this recession is its impact on lower wage earners: they have experienced a much higher level of unemployment for a much longer period of time than higher wage earners. Thus, the wealth gap has expanded even further — and it was already getting too wide prior to COVID. This is worrisome because large gaps in wealth can ultimately be a threat to democracy and capitalism.

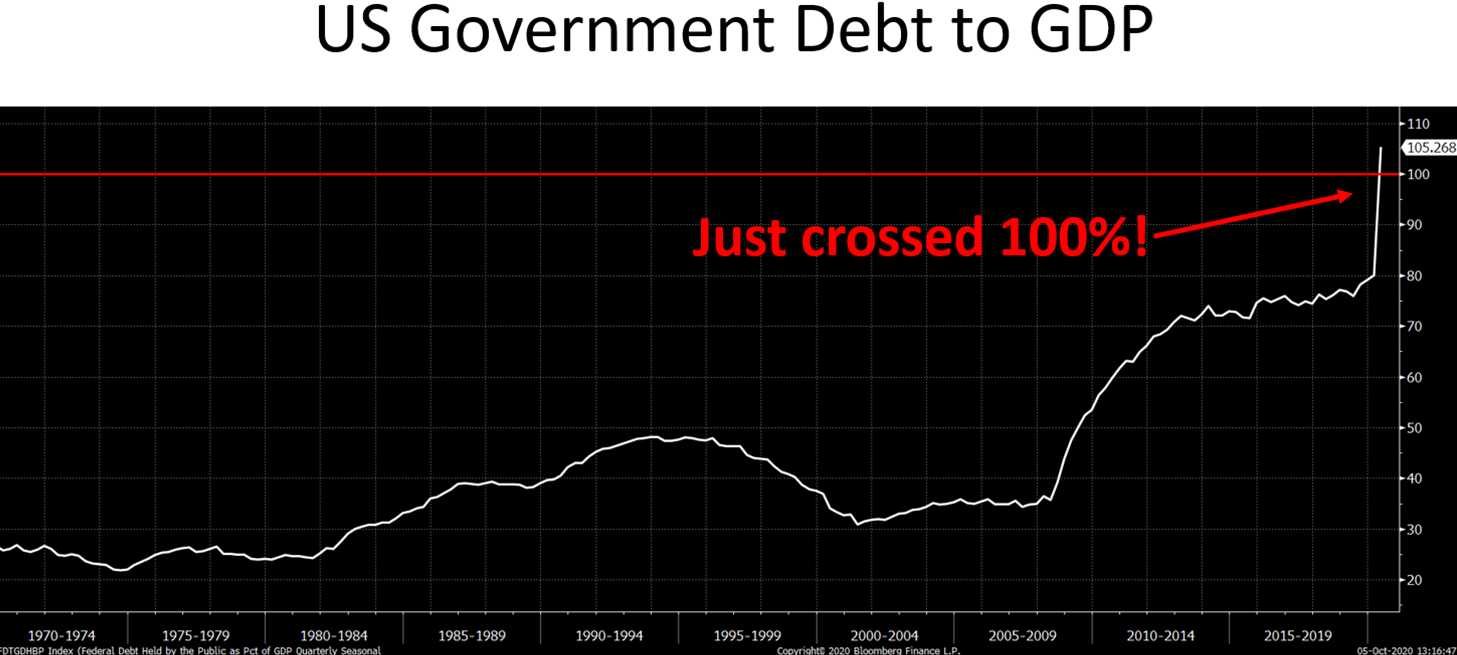

And finally, the amount of federal money being thrown at this recession is unprecedented. Whenever the next stimulus is agreed upon, the total amount of government stimulus will be larger than the total annual economic output of EVERY COUNTRY IN THE WORLD WITH THE EXCEPTION OF CHINA. More than that of Japan, Germany, France, or the United Kingdom. That’s ridiculously amazing.

__________________________________________

With all this money being thrown at the problem, conventional wisdom would seem to tell you we must be on the brink of an era of hyper-inflation. And maybe we eventually will but . . .

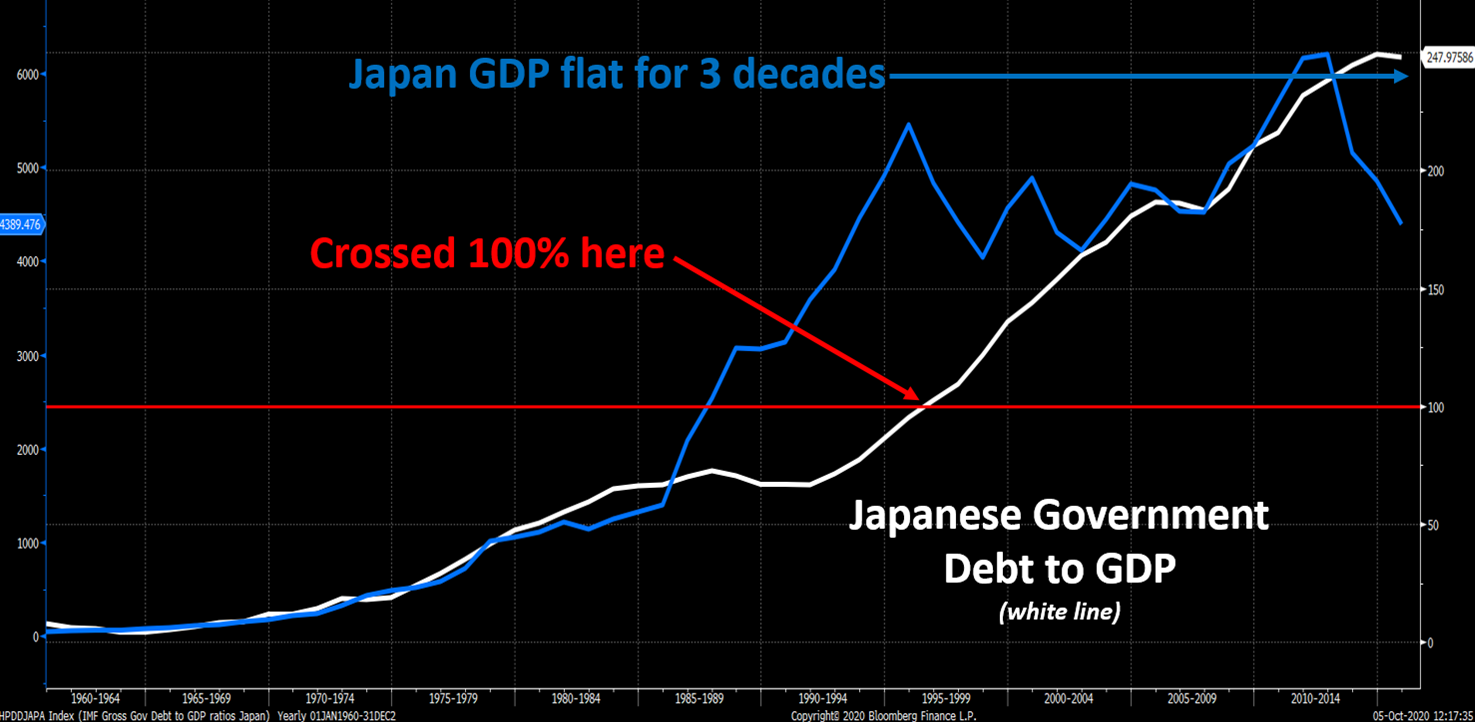

As we pointed out during our webinar, Japan’s spending has caused its debt to increase to an amount that equals almost 250% of its economic output (GDP). Since Japan’s debt passed 100% of GDP in 1996, its economy has had zero growth (net, net, net).

Why is this significant? Because Japan, even with all its debt, has not experienced hyper-inflation. On the contrary, the country has experienced low inflation (sometimes deflation) and negative interest rates.

With the COVID aid packages added to our country’s previous massive debt load, the United States’ debt has officially exceeded 100% of GDP this year, leading us to believe that future economic growth for the U.S. could be challenging (regardless of who wins the election) and that both inflation and interest rates could fall lower. We expect the U.S. 10-year Treasury Bond to someday trade with an interest rate close to zero or below zero (currently 0.75%).

In our September Investment Commentary, we noted that there are much greater forces that affect our country’s economic health beyond the person occupying the Oval Office. In addition to the excessive debt, the negative/positive outcomes for the U.S. are less a result of who is president and more a result of geopolitics and demographics. That has always been the case.

What hasn’t always been the case is the influence of Twitter and Facebook. Social media has taken every facet of this election and magnified it beyond reason. And the continued need for many to quarantine has caused people to spend more time on social media, resulting in more angst and stress than we could have imagined.

So if you are feeling more stressed about this election than any previous one, ditch Facebook and Twitter.

Vote.

And remember, if your candidate doesn’t get elected, in four short years, we get to have another election.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.