After a yearlong delay due to COVID, the 2020 Olympic Games were finally pulled off. Viewers around the world tuned in to watch the best athletes compete for gold in gymnastics, track and field, swimming, and . . . dressage?

The world also watched as the United States and China competed in the overall medal race. In the end, the U.S. ended up with 113 medals, which was 25 more than second-place China. However, the U.S. eked out only one more gold medal than China.

The medal race is sort of a proxy for the broader struggle for economic supremacy between the two countries. The U.S. and China may garner the spotlight for collectively earning about 20% of all Olympic medals, but when it comes to economic prowess, they are even more dominant. Together, the U.S. and China make up nearly half (42%) of the world’s economy, so investors like to pay attention to how they get along.

U.S.-China relations are under some stress. If you need any evidence, consider that while the Biden administration is busy re-working many of the policies of the previous Trump administration, the current and former leaders both deem China to be a threat to our economy. Trump waged a tit-for-tat trade war a couple years ago, and Biden views China’s “autocratic ambitions” as one of the “great challenges of our time.”

And now this already tenuous relationship is being put under further strain with China’s crackdown on big tech.

It started last November, when Chinese president Xi Jinping personally intervened to block the Initial Public Offering (IPO) of shares of fintech giant Ant Group — seemingly because the company’s founder criticized bank regulators a week before. And then last month, markets were shocked again when the Chinese government forced the removal of the mobile app Didi (basically, the Chinese version of Uber) from phones in China. Didi had just gone public in the U.S. two days prior. Allegedly, Didi was not adhering to certain cybersecurity regulations.

Most recently, just last week, warning shots were fired at Tencent, China’s big tech conglomerate (and largest company by market cap). Chinese state media denounced video gaming as “spiritual opium,” and it’s no coincidence that Tencent controls one of the world’s biggest video gaming businesses. Tencent’s stock plummeted the next day.

The tech community is now on notice, and, overall, Chinese regulators have fined over 30 big tech companies for violations of rules that have suddenly cropped up.

Why is China doing this? A few reasons . . .

The government wants tighter control over tech companies and the information they possess. These firms, not unlike the Chinese government, collect troves of data on Chinese citizens. In fact, there is a law forbidding all Chinese companies from storing their data outside the country’s borders and big tech companies aren’t even allowed to be owned by foreigners (more on that later).

Also, China wants to curb the rise of other centers of power within the country that could possibly rival (read: threaten) the government’s authority. China is communist, but it allows for some free-market capitalism, which has given these tech firms the opportunity to flourish. The companies need to be careful, though: gain too much power and influence and the government will rein you in.

Lastly, the Chinese government wants economic growth to adhere to a certain overall master plan. Economic growth in China must serve the government’s geopolitical strategic interests. It wants more manufacturing, biotech, semiconductor fabrication, etc., and fewer consumer internet companies that sell ads (like Facebook or Google in the U.S.).

These actions are all a subtle indictment of the way business is done in the U.S. We want our economy to grow, but, for the most part, the government is not going to strategically pick and choose the winners. The U.S. government has been slow to regulate big tech (although the topic gets plenty of media attention). Government red-tape exists, but it doesn’t magically pop up after something critical is said about regulators.

What does this all mean?

It’s another step backward in economic relations between the two countries. The Chinese government’s willingness to choke off the pipeline of funding from American capital markets does not spell doom for international relations, but it’s sure not helping. Don’t get us wrong, our economies are still intertwined, but we expect this struggle between the world’s economic superpowers to last a long time.

What to do in the short-term? Be wary of owning Chinese tech stocks! That’s because they are not really “stocks” in the traditional sense, but a complicated security known as a Variable Interest Entity (VIE).

The VIE has no ownership of the underlying business. It’s just a shell company based in the Cayman Islands with no hard assets, yet it has signed contracts with the actual Chinese tech company, allowing it to receive a share of profits. Remember how Chinese law prohibits foreigners from owning these tech companies? At any moment, the Chinese government could void those contracts. The VIE structure has been a nice workaround, but it’s technically illegal.

It is entirely possible that the Chinese government could crack down on this financial monstrosity and leave investors holding the bag. The problem is that people have been unwittingly pouring money into these Chinese tech stocks (a.k.a. illegal VIE accidents waiting to happen), unaware of the risks. This year, these “stocks” have collectively lost hundreds of billions of dollars in value. The real risk isn’t that they will lose some value, but that they will lose all value.

__________________________________________

The end of July marked a milestone in the U.S. stock market’s recovery from the pandemic. The S&P 500 index is up over 100% since the panic bottom on March 23, 2020. A HUNDRED PERCENT!

To put this in some context, consider that prior to the “pandemic” crash of March 2020, it took the market four years to double.

It took only six months from March 23 to get back to even, but the market hasn’t slowed down. It has tacked on another 31% since then.

What is behind this growth in the stock market?

People typically invest money when they think a company is going to increase its earnings in the future. (We say “typically” because a growing portion of people buying shares in the stock market view it as a substitute for Las Vegas and pay very little attention to metrics like revenues and earnings.) So, typically, the stock market reflects future expected earnings growth. Today, markets are pricing in a massive 30% increase in corporate profits for the coming year. Anything less would be a disappointment to investors.

One company that did not disappoint through the pandemic was L Brands (LB). This company, which owned Victoria’s Secret and Bath & Body Works, was up a whopping 775% and was the best performing stock in the index!

But it wasn’t the scantily clad “Angels” driving them through the pandemic. No, very few people were trying to impress via undergarments in 2020 (which has been reflected in the declining birth rates of 2021). Rather, it was their other segment (the one offering soaps and hand sanitizers in your favorite scents) that drove growth. Bath & Body Works registered a $1 billion revenue increase from Jan. ’20 to Jan. ’21, all of which came from online sales. This was a stock that was down about 70% over the five years before the pandemic started. Talk about a COVID silver lining for L Brands!

In a further development, last week L Brands changed its ticker symbol to BBWI and spun off its Victoria’s Secret unit into a separate entity (VSCO).

__________________________________________

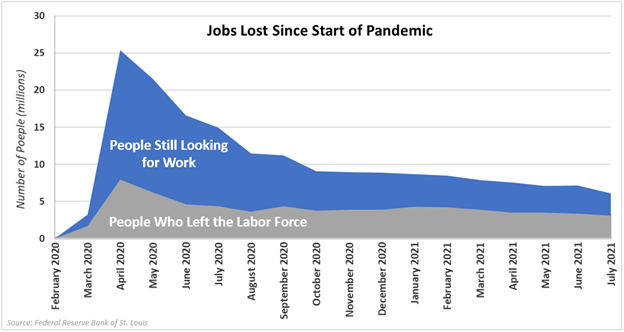

While the stock market has exceeded pre-pandemic levels, we are still playing catch-up in the job market. The number of jobs lost because of the pandemic peaked in April 2020, at 25 million.

Since then, we have recovered 19 million jobs, but there are still over six million people who were working before the pandemic who are not today. And half of those six million people left the labor force entirely (represented by the gray section of the graph above), so they are not counted in the official “unemployment rate,” which clocked in last Friday at a pandemic low of 5.4%.

A portion of those who left the labor force were Baby Boomers who decided to go ahead and retire. The pandemic sped up a lot of trends and this was one of them. Others had to leave work to stay home to watch their kids. Some went back to school. Some became discouraged when looking for a job. But some were likely encouraged to stay out of the labor force thanks to increased unemployment payments. It is no coincidence that, as the extra payments have rolled off in many states, we have seen rising employment numbers.

There are skill mismatches and other factors frustrating efforts to solve the unemployment problem, but almost anyone who wants a job ought to be able to get one. As of the latest tally, there were over ten million job openings in America. You see this every time you venture out your door. “Help Wanted” signs are everywhere. The demand for labor is as high as it’s ever been.

We hope to see those positions get filled, because unemployed people subtract from economic growth. Working people add to it. They also tend to be happier and healthier.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.