Contrary to what many “experts” would have you believe, no one — and this includes our team at Boyer Corporon Wealth Management — has a crystal ball (although we do consult our Magic 8 Ball and it says, “Ask Again Later”). We can make educated predictions, but we do not know when the next market crash or rally will occur. People who tell you otherwise are either delusional or lying. For example, in January 2016 an analyst at the Royal Bank of Scotland told people to “sell everything except high quality bonds.” Three months later, the S&P 500 and the FTSE 100 Index (the London Stock Exchange index) were up 7% and 5%, respectively. Those who were still out of the market a year later missed out on 20%+ returns and if they were STILL out of the market two years later, they said goodbye to 50%+ returns! Analysts make predictions of this sort every year. Inevitably, a handful of them turn out to be right and are showered with praise for being able to predict a market crash. In the meantime, those who are wrong continue to add to their casualties.

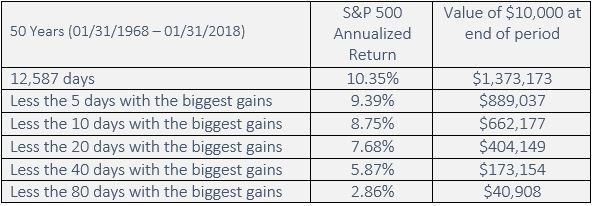

It is dangerous to time the market. If you had invested $10,000 in the S&P 500 fifty years ago, your annual return would have been 10% and the value of your investment just under $1.4 million today.

If you missed out on the five days with the biggest gains, your investment after fifty years would have grown far less, to $889,000. You missed out on close to $500,000 by being out of the market for only five days!

The following table, while hyperbole, drives home the point:

At BCWM, we don’t make huge bets on market swings. Our clients don’t need that type of risk added to their portfolio, as Eric Clark outlines in the article “What is Your Tolerance for Investment Risk?”

Our job is to position our clients’ portfolios so that they succeed in reaching their required average annual after-tax rate of return with as little risk as possible. This is done using tactical asset allocation and security selection, a process that places a high emphasis on protecting against the downside, even if it means sacrificing some upside.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.