There are two likely paths for the U.S. economy in the year ahead:

1) Continued high inflation

2) Recession

There is also a third possibility: a combination of the two, also known as “stagflation,” but we don’t classify it as “likely.”

With continued high inflation, the Federal Reserve is in the hot seat. Its goal is to sufficiently raise short-term interest rates to corral inflation into a normal range. If it raises them too much (smothering rather than dampening economic growth), the result is a recession.

There is even a fourth option, the illusive “soft landing” scenario, where the Fed stamps out inflation, the economy keeps on growing, and we all hold hands and sing kumbaya. We reckon that scenario unlikely.

While we don’t think the Fed can pull off a miracle, we do believe it can bring inflation under control. Paul Volcker, the legendary Fed Chairman, discovered the solution during the massive inflation wave that started in the late 1970s: raise interest rates until you break the inflation cycle. Although Volcker did usher in a recession or two in the process, today he is considered a bit of a hero, especially by members of the Federal Reserve. We like to think they all have giant posters of Volcker above their beds and dream of one day battling inflation for their country just like he did.

That day has finally arrived.

On Wednesday, the Fed hiked interest rates by 0.75%, the largest one-time hike since 1994. And it has signaled it could raise rates an additional 1.75% by year end.

This move by the Fed has been in response to the most recent inflation report, which incited fear in the markets (ALL the markets). The S&P 500 has entered into a bear market (currently down about 24% from its high) and the bond yield curve has inverted, a traditional warning sign for an impending recession.

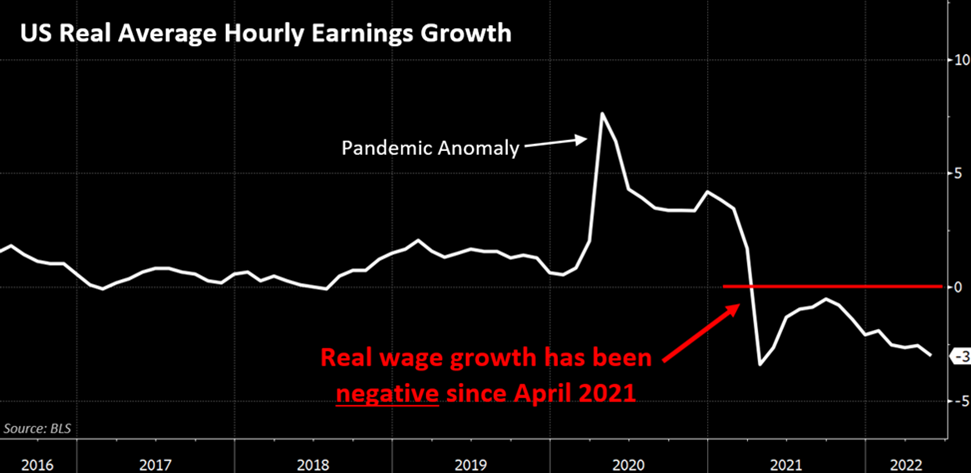

If you only need one data point to know why high inflation is bad for an economy, look at wages. When the growth in the cost of goods and services (inflation) outpaces wages, the standard of living decreases. If inflation outpaces wages for too long, it can cause a recession. Wages minus inflation is what we call real wages, and, as the graph below shows, real wage growth has been negative for over a year.

On the other hand, if rising inflation leads to higher wages which leads to higher inflation which leads to higher wages . . . we start to see the ugly feedback loop from the inflation of the ’70s/’80s. We don’t expect that development for a number of reasons, the main one being that the Fed has the desire and willingness to stop it.

_____________________________

Another economic concern is the housing market. It has traditionally been a strong indicator of economic health, and some red flags are beginning to appear.

For the past decade, a combination of low supply (homebuilders slow to build) and high demand (low borrowing costs and Millennials finally leaving their parents’ basements) has led to home prices hitting all-time highs.

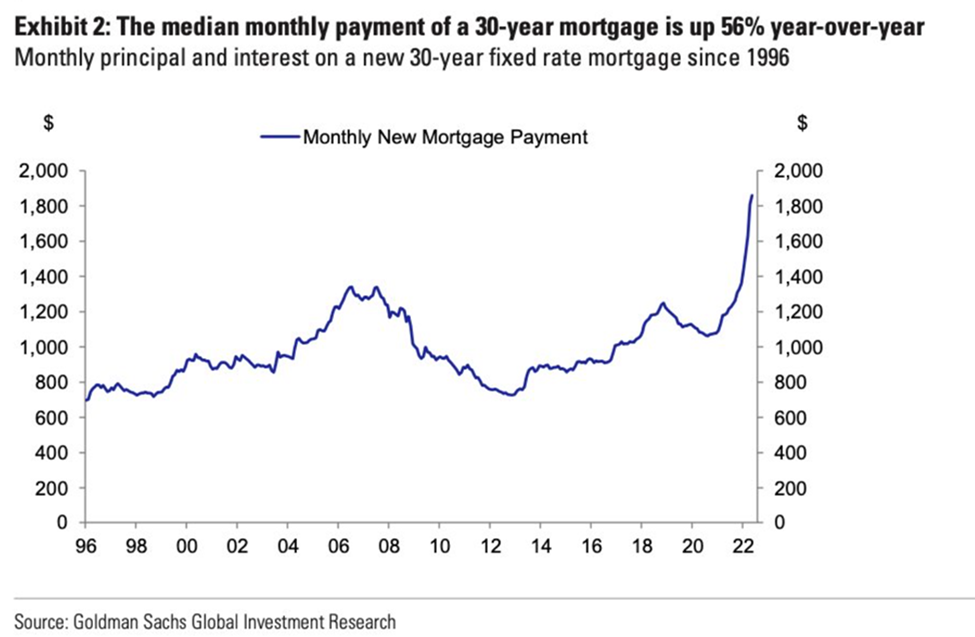

Interestingly, high home prices have not been much of a problem, because most everyone takes out a mortgage to buy a home. And low interest rates have counterbalanced the high prices, keeping mortgage payments rather steady. Home “affordability” has not been a concern.

That is about to change.

30-year mortgage rates just hit a 14-year high of 5.78%, doubling this calendar year.

Combine high home prices with higher mortgage rates and home affordability becomes a problem. Excluding the housing bubble of 2008, homes are the least affordable they have been in thirty years. Consider this: for the same amount borrowed, monthly mortgage payments today are 56% higher than they were a year ago!

One could argue that the housing market needed to hit a speed bump given the cutthroat competition among buyers in recent years. We’re already seeing signs that a housing slowdown has begun. But rest assured, we don’t expect this to resemble anything like the 2008 Sub-Prime Mortgage Crisis. Back then, anyone who could fog a mirror qualified for a mortgage. Lending standards are a tad bit more stringent today.

_____________________________

While we still don’t know if we’re in a recession, markets are forward-looking, and they have certainly begun to adjust for that likelihood. As we noted last month in “Nowhere to Run, Nowhere to Hide,” almost all asset classes have taken a beating this year. Traditional hedges to stocks, such as gold and bonds, have provided negative returns. And if you thought you’d be safe staying in cash, the “real” return (after inflation) is also negative.

Not too long ago, a large contingency of “investors” believed Bitcoin and other cryptocurrencies offered not only a path to big investment returns but also the best way to hedge inflation and even diversify an investment portfolio. You know . . . an asset class that would perform well when others don’t.

We don’t always get everything right, but here we were dead on. In our May 2021 commentary titled “FOMO,” we pointed out that “the primary difference between cryptocurrencies and Las Vegas is that when you gamble in Vegas, you get free drinks.” After hitting $67,000 seven months ago, Bitcoin is now trading below to $21,000, about a 70% decline. Not much of a hedge.

Not to go on too much of a rant, but we are yet to be convinced of the benefit touted for cryptocurrencies. And we really do try to be convinced! If the financial system as we know it is about to undergo a radical shift, we don’t want our clients to be left behind. But the more we research crypto, the more we see a solution that is looking for a problem.

In the past few weeks, several high-profile crypto companies have completely imploded. A recent example: Celsius, a company that claims to be a crypto substitute for traditional banking, recently halted withdrawals from depositors. It appears to be in the midst of an old-fashioned bank run . . . something normal banks have managed to avoid for years thanks to silly old regulations such as capital and liquidity requirements, risk management, etc.

_____________________________

As we watch the Fed try to stamp out inflation, we know it will likely dampen the economy (or worse). Fortunately, our investment approach is not predicated on making money in a massive bull market, taking excessive risks. Thanks to our belief in sound companies with cash flow, purchased at the right price, this year BCWM’s equity investments have done what they are designed to do in a down market, outperform the broader market.

An unusually poor performing asset class has been fixed income (bonds). Interest rates have rapidly increased in 2022, pushing bond prices down. We believe that is a temporary phenomenon, one that will reverse as the Fed kills the economy and long-term interest rates resume their downward trend.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.