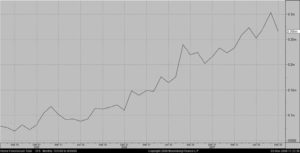

The number of new home foreclosures for the month of September was announced October 23rd. There were 265,968 new foreclosures according to RealtyTrac. This was a 21% increase from September, 2007 but a 12% decline from August. However, according to RealtyTrac, much of the decline from August to September can be attributed to new state laws that “slowed the pace” at which lenders could move forward with foreclosures. That means the problem hasn’t been solved nor is it ending. It means it has been postponed for a few months. Below is a chart from Bloomberg showing monthly foreclosures for the past 3 years.

What is more disturbing is that, according to First American CoreLogic, approximately 20% of U.S. homeowners that have a mortgage, have a mortgage balance that is greater than the fair market value of their home. That means one in five have a financial incentive to walk away from their obligation to make their house payment.

One of the most inane economic statistics is the one that defines a recession as two consecutive quarters of negative growth. That definition by itself is not necessarily inane. What is inane is that it isn’t until AFTER the two quarters do the experts declare “yes, we were in a recession” during that period. We have been saying for a long time that we are in a recession and could be in it longer than anyone expects. Gross Domestic

Product for the 3rd quarter stated the obvious: the economy shrunk by 0.3%.

The 4th quarter can’t possibly be any better. Thousands of job cuts were announced in October (Wall Street alone has announced over 200,000 job cuts). And most other developed nations have economic problems as bad (or worse) than the U.S. That, combined with an impressive increase in the value of the dollar, means we will likely be exporting less. Decreased domestic consumer demand and fewer exports point to another quarter of negative growth. We do not have to wait until the two quarters are over to tell you we are in a recession….a global recession.

Because of the global recession, there was a dramatic decline in the price of commodities in October (silver lining?). A few examples:

Oil ↓ 33%

Corn ↓ 18+%

Wheat ↓ 20+%

Copper ↓ 36+%

This will remove some of the pressure the average consumer has been feeling (I paid $1.99 per gallon the other day to fill my tank). We don’t think this will be enough to revive the U.S. economy any time soon.

The equity markets all over the world were destroyed in October. The Dow Jones Industrial Average declined over 24% by October 27th and rallied the last 4 days to finish down about 14%. The S&P 500 was down over 27% and recovered to finish down 16.9%. But if you think things are bad here, check out these international stock indexes:

Nikkei 225 (Japan) down 36%, recovered to finish down 23.8%

Hang Seng (Hong Kong) down 38.8%, recovered to finish down 22%

FTSE (London) down 21%, recovered to finish down 12%

On Thursday, October 23rd, Alan Greenspan, former chairman of the Federal Reserve, spoke in front of a congressional committee. Let me summarize it for you….”I screwed up!”. He said, among other things, he wrongly assumed that lenders would carry out proper surveillance of their counter-parties (the people to whom they lent the money).

If America has learned nothing else this year, it is that, just because someone is wearing a suit and tie, is carrying a briefcase and has an Ivy League degree, we should not assume they will always have the answers we need. Wall Street firms (the experts) have lost over $200 billion in subprime mortgages, a couple firms no longer exist and many of them are teetering on the edge of bankruptcy. This year will cause many Americans (and non-Americans) to re-think how and where they are getting their financial advice.

Early in October, congress passed a bill known as TARP (Troubled Asset Relief Program) which will be administered by the Treasury’s new Office of Financial Stability. I’m sorry, but is it wrong for us to assume that the Treasury and the Federal Reserve should have always been the “Office of Financial Stability”? This bill authorizes a total of $700 billion to accomplish a variety of tasks, all designed to allegedly provide relief to our credit markets, which are not working very well at all. As of this writing, there is concern and allegations that some financial institutions receiving TARP funds are, at the same time, paying substantial bonuses to employees and dividends to shareholders. This obviously raises the question about the need for that institution to receive TARP funds.

And last, but definitely not least, we have an election in 3 days. By the time this is posted on our website, the election should be over. However, if it is a close election, we expect several “re-counts” that could take weeks. Don’t be surprised if that happens. Currently Obama has an impressive lead in most polls. Although there are quite a few swing states, we feel Ohio and Florida are the most significant.

We repeat what we have said in an earlier monthly Investment Commentary….we are not positioning our portfolios to accommodate the result of the election. The economic issues today (foreclosures, the credit crisis, job cuts, and the volatile securities markets) are much bigger than either of the presidential candidates. The loser might be the winner in this election.

At Boyer & Corporon Wealth Management, we continue to be very cautious on the equity markets. The 14% rally last Tuesday through Friday did not impress us. We cannot imagine sustaining a bull market in a period of declining earnings and contracting P/E ratios. In the 1980’s and 1990’s, you could pretty much throw darts at the Wall Street Journal every January 1st, purchase the stocks the darts hit and count on making 10% – 15% every year. They were two decades of increasing earnings (with a few bumps along the way) and expanding P/E ratios. The next several years could be a period where you can get a decent return buying equities, but not by throwing darts. We are going to be very selective.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.