Wealthy people have been getting bashed pretty regularly lately… even by themselves. Warren Buffet gave President Obama extra fuel for higher taxes by admitting his “secretary” pays taxes at a higher rate than he does. Rest assured she doesn’t actually pay more tax than Buffet, she just pays at a higher rate because virtually all of his income is from dividends and capital gains, which are taxed at 15%. Obama used this revelation to implore Congress to help his efforts to get the wealthy to start paying their “fair share.”

I don’t know if raising taxes is the answer. I’m pretty sure that taxes, particularly on capital gains, will be raised. It certainly seems like a simple solution to a simple problem… we need money to reduce our debt, the wealthy have the money, let’s get it from them. It might even BE the right thing to do. I don’t know.

But what seems to be lost in all the rhetoric and demagoguery is that the wealthy ARE paying a lot of taxes. That doesn’t mean they shouldn’t pay more… but a working definition of “fair share” might be in order. Currently the top 10% of taxpayers are responsible for approximately 70% of all taxes collected. And over 50% of Americans don’t pay taxes at all. And nothing the wealthy have heard lately sounds anything remotely like “Thank you.”

There’s something else that seems to be conveniently left out of all the wealthy-bashing. These despicable “millionaires and billionaires” and “corporate jet owners” who own all these shares of company stocks and sit around collecting millions in dividends are only taxed at 15%… well, that’s not completely accurate. Shareholders (some of whom are NOT millionaires) are “OWNERS” of the corporation. The corporation earns money and pays taxes as a corporation (yes, most corporations actually pay taxes… you just hear about the few nasty ones that don’t). After paying taxes, the corporation sends dividends to the owners/shareholders, which are then taxed again at 15%. This is called “double taxation,” the imposition of two taxes on the same income.

I’m not saying taxes shouldn’t be raised. I’m just pointing out that some billionaires, after accounting for taxes paid by the corporations they own, actually pay taxes at a higher rate than their secretaries… that they actually might be paying their “fair share.”

If our government wants to raise tax revenue quickly, taxes will need to be raised on dividends. Increasing taxes on realized capital gains might not have much of an effect… who has gains? Most investors have realized LOSSES, not gains.

If you’re concerned that the gap between the wealthy and the poor keeps getting wider, you might be interested in what the Fed announced in September.

On September 21st, Ben Bernanke and the Federal Reserve Bank announced their latest effort to help revive the U.S. economy, dubbed Operation Twist. In another misguided effort to postpone the inevitable pain associated with excess leverage, the Fed stated they would liquidate $400 billion of short-term U.S. Treasuries and use the proceeds to purchase long-term U.S. Treasuries. In addition, they stated they would use proceeds from previously purchased mortgage backed securities to purchase additional mortgage backed securities.

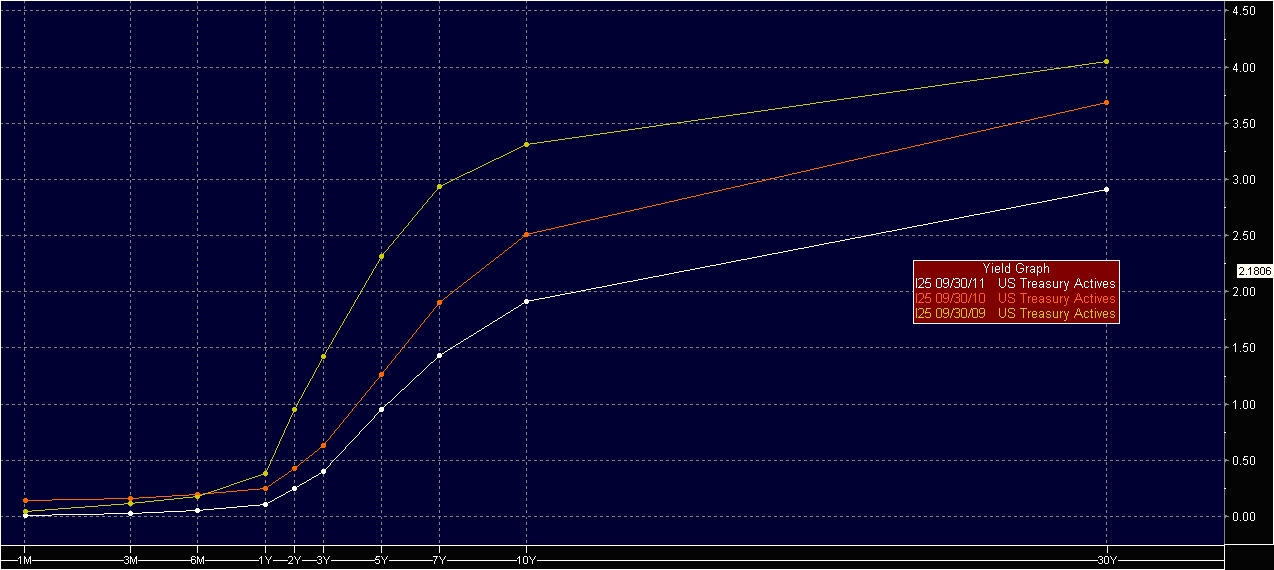

The upshot of all this is that mortgage rates will decline and the interest rate on long-term Treasury Bonds will decline. The result will be that the yield curve becomes flatter… in other words, short-term bonds will have slightly higher interest rates and long-term bonds will have slightly lower interest rates. Below is a graph which illustrates this. The yellow line represents Treasury interest rates two years ago, the red line one year ago. The white line is the current Treasury yield curve.

Today, the yield curve is much flatter. Although we are not yet seeing an increase in short-term rates, rates on the 10-year and 30-year bonds have declined significantly.

In a perverse way, this is a very cruel joke played on the poor people of America. The gap between the wealthy and the poor in America has steadily become wider over the past decade. And this little plan from the Fed will slowly and quietly make that gap wider.

Why? How? The Fed intends to keep long-term interest rates, including mortgage rates, as low as possible. This sounds like a good thing. Businesses can borrow at lower rates and homeowners can re-finance at lower rates. Everyone has lower interest rates and more money to spend because they are spending less money on interest. Refinancing your debt can give you the cash to spend on a new automobile, an iPad, an exotic vacation, or to pay down existing debt.

What’s the cruel joke? Poor people don’t benefit from refinancing. They don’t even have a “finance” to “refinance.” They rent. The entire refinancing phenomenon is lost on them.

Lower middle class who own a home also don’t benefit much. They have either lost their jobs, ruined their credit scores, or their home has declined in value such that its Fair Market Value is less than what they owe. For that reason, no mortgage company will offer them a new mortgage at a lower interest rate. They are stuck paying their mortgage at a higher rate while the wealthy enjoy lower monthly payments.

Banks and mortgage companies only accept home owners who qualify to refinance… those with good credit scores and a home that is worth a lot more than the mortgage. In other words, they prefer wealthy people. So the wealthy people have more money to spend or save, and the poor people… well, they just stay poor.

I’m sure that wasn’t the intended goal from this plan. It’s just an unintended consequence.

Many years ago, I developed a simple principle for guiding investment decisions… “if it is too complicated to understand, it is designed to rob you of your money.” Admittedly it is a principle that I developed after learning a lesson the hard way. But it has served me well since.

I was reminded of it last week when it was announced that a method was devised to solve the European debt problem. Although it hasn’t officially been adopted, it includes the following acronyms: EIB, SPV, EFSF, ECB and PIIGS. PIIGS, as you know, are the countries in financial trouble (Portugal, Ireland, Italy, Greece and Spain). The bad debt from the PIIGS is apparently being held by many banks, primarily European banks. It seems that these banks may own too much debt from the PIIGS. Under the proposed plan, the PIIGS debt would be taken from the banks and replaced with new bonds. The new bonds would be issued by the SPV (Special Purpose Vehicle… not the lunar one). The SPV, created by the EIB (European Investment Bank), would get money for this from the EFSF (European Financial Stability Facility). The bonds issued by the SPV could be used as collateral by the ECB (European Central Bank)… and it is at this point even I don’t understand what is going on. I’m pretty sure that, by making it really complicated, they think they can convince stupid investors like you and me to invest money with them.

Rest assured we will not be investing in bonds issued by an SPV which was created by the EIB so that the EFSF could help the ECB leverage more capital to help the PIIGS.

September was the fifth consecutive month of stock market losses. The S&P 500 declined 7.02% in September, 13.87% in the quarter, and it is down 8.69% YTD. As I am writing this on the first workday of October, the S&P 500 gave up another 3%. And, as I point out every month, if you had been invested in the S&P 500 index without any management fees since the end of 1999, you have less money today than when you started.

We are not officially in a depression. Technically, we are not even in another recession, although most people seem to agree that it sure feels like one. With 20% of Americans still sitting on a mortgage balance that is higher than the value of their home, and default rates ticking back up, the value of residential real estate continues to decline. Although the American consumer has been on an austerity kick for several years, household debt remains historically high. Deleveraging continues to be the theme. And unemployment stubbornly remains at 9%+.

I’ll leave you with some good news. The price of oil is finally experiencing a significant decline… under $80 per barrel. We are beginning to see that translate into lower prices at the pump. For most Americans, this is like getting a tax reduction.

Other commodities like sugar, corn and wheat have declined 30% – 40% since their prices peaked earlier this year.

Corporate balance sheets are very healthy (as if they might be expecting tough times… imagine that). At Boyer & Corporon Wealth Management, we think corporate bonds look attractive. We are still seeing municipal bonds trading at low prices (high yields) as if there is going to be a plague of municipal bankruptcies. And lastly, some stock prices have been halved and have dividend yields close to 5%. Good companies making money. That doesn’t mean they won’t decline further though because… you know, they are going to raise taxes on those dividends so rich people will pay more than their secretaries.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.