The most interesting technology grabbing headlines over the past couple of months is called ChatGPT. It is essentially a Google search on steroids. You can ask it anything and it will provide an answer, even answering in the style of your choosing (Southern drawl, Shakespearean prose, biblical, etc.).

It can write poetry, solve math problems, tell you a joke, write computer code. It can even give relationship advice. It can write an essay in less time than it takes to order takeout from UberEats. College kids must be loving this. But the professors? Probably not so much.

You’ve heard of artificial intelligence (AI)? Well, ChatGPT is artificial and it’s definitely intelligent.

For example, if we decided to take the easy way out and have ChatGPT write our Investment Commentary, it might start something like this:

Hey, that’s pretty good! But get too complex with your request and ChatGPT can spit back some bizarre (and sometimes incorrect) answers. For now, we’ll stick to writing our Investment Commentary.

__________________________________________

There may be someone somewhere who has a rosy outlook of the U.S. economy, but they are few and far between. The overwhelming consensus seems to be that the USA is doomed to sink into an economic recession later this year.

Fueling that concern is a litany of worrisome indicators:

- The omniscient “yield curve” has inverted. In normal times, long-term interest rates are HIGHER than short-term interest rates. But every so often this relationship “inverts” and long-term rates become LOWER than short-term rates. This phenomenon has preceded every single recession for the past 70+ years!

- The housing market is reeling. New home sales are dropping precipitously, down 27% from last year. We’re not facing another crisis, but housing-market data is typically a great harbinger of what’s to come.

- Manufacturers are much more pessimistic versus a year ago.

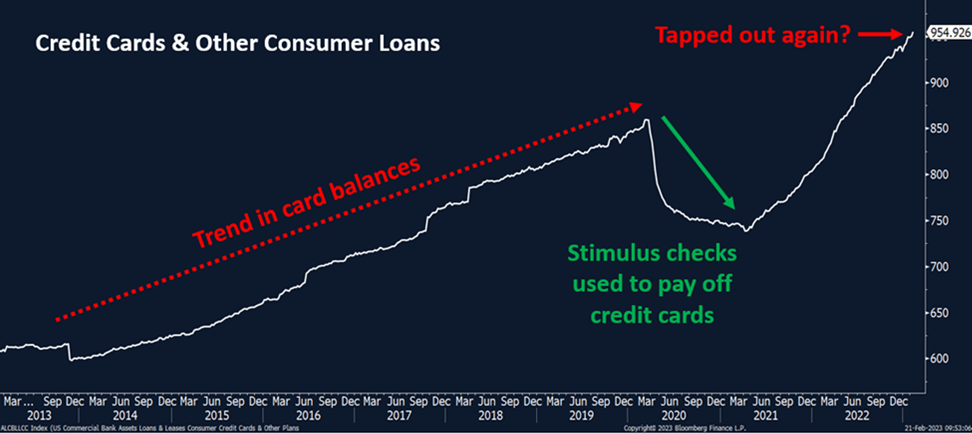

- Wages are not keeping up with inflation. Additionally, it seems that consumers have tapped out their credit cards again.

On the other hand, there are indicators that are not so worrisome:

- In January, 517,000 new jobs were created. For context, the labor market had been adding around 315,000 jobs per month since August. The unemployment rate (3.4%) is the lowest since 1969, right before the Kansas City Chiefs won their first Super Bowl (sorry, we couldn’t help ourselves).

- Consumers keep spending. Retail sales increased 3% in January, the largest monthly jump in nearly two years.

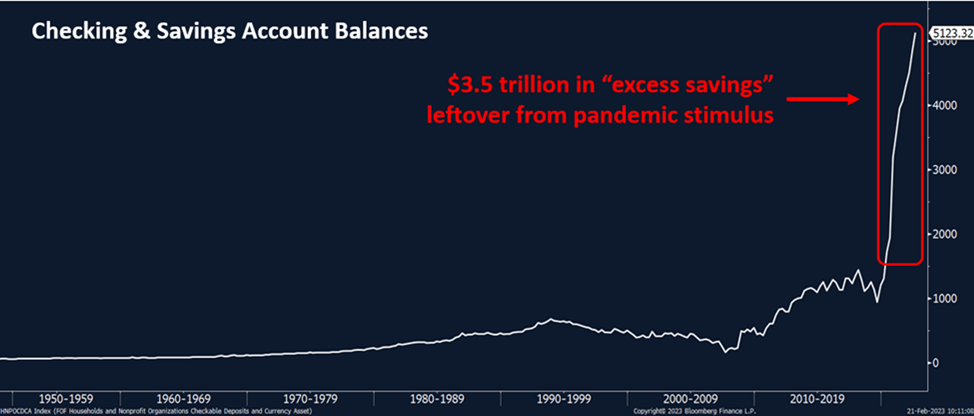

- There is still $3.5 trillion in “excess savings” from the pandemic sitting on the sidelines. This doesn’t jibe with the rise in credit card debt mentioned above. What’s going on? We suspect that the majority of the savings are in the hands of wealthy people (who don’t need to spend it), whereas the increase in credit card balances was almost assuredly incurred by lower-income households.

Perhaps the biggest reason why we might not have a recession is because everyone expects we are heading into a recession. And one thing we have learned about economies and investments is that when EVERYONE expects things are going in one direction, there is a high likelihood they will go in another.

It’s just never that easy. We pride ourselves on attempting to be contrarian investors, zigging when others zag. It’s not easy, and one can be correct but appear to be incorrect for a long time.

Here are a few things we have learned over the years:

- The obvious is hardly ever obvious

- When it’s obvious (to everyone!) that we are heading into a recession, don’t be surprised when things turn out better than expected.

- The seemingly easy is almost always difficult

- Investing in stocks in 2021?

- There is never a sure thing

- Can you say Bernie Madoff?

- The complex is almost always designed to fleece you

- Insurance as an investment

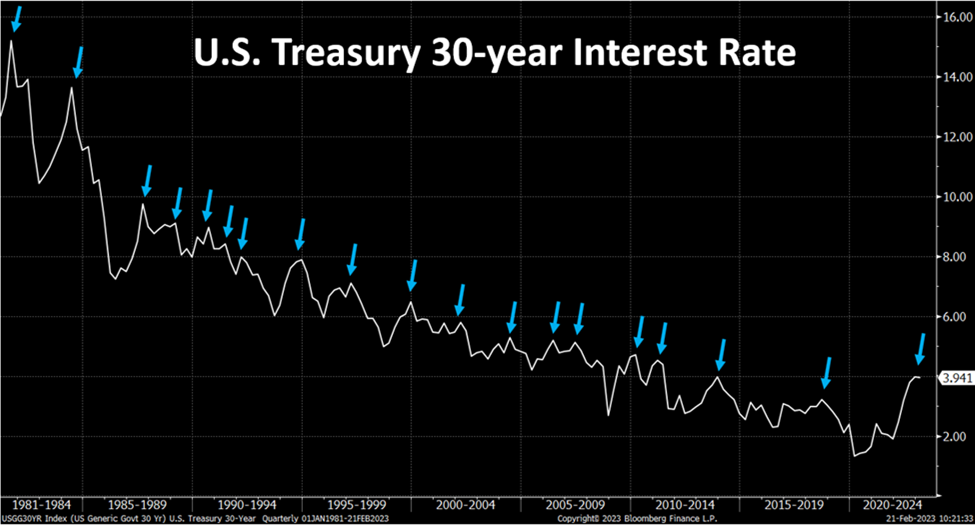

We have seen a recent up-tick in interest rates. But our long-term outlook is still for a slowing economy and lower interest rates.

Perhaps there is one more worrisome indicator:

We are smart enough to know that correlation does not imply causation. However, the first two times the Kansas City Chiefs hosted a Super Bowl parade (1970 and 2020), a recession immediately followed . . . a trade-off most Kansas Citians are fine with. A week ago, downtown Kansas City looked like this:

Brace yourselves.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.