In the past two months, the stock market has rallied, gaining over 17%. Of course, that’s on the heels of a decline in excess of 22% since year end, so the market is still down about 9% for calendar year 2022. (Trust us, the math is correct.)

As we have noted before, the most significant damage to investment portfolios this year has been from fixed income (bonds), not the stock market. Although the bond market has recovered somewhat from its lows, bonds are still down more than stocks this year . . . making “conservative” portfolios appear less conservative than aggressive portfolios. The key word there is “appear.” Comparing portfolio performance results over a relatively short period can be dangerous. We recommend against it.

Bonds have underperformed due to fears about higher inflation and higher interest rates. A year ago, the Federal Reserve maintained (and we agreed) that inflation would be “transitory.” And it wasn’t long before “transitory” became a dirty word. But inflation may well have just peaked. The month of July saw 0% inflation. We don’t get excited about one month (prices are still up 8.5% year-over-year). However, if we continue to see lower levels of inflation, the “T word” debate may be put to bed.

Recently, the larger question has been about the “R word.” “Are we in a recession?” We hear it almost every day. We’re not sure what anyone plans to do differently based on the answer to that question, but many still seem compelled to ask it.

It seems to us that the more people who ask that question, the less likely we are in a recession. Because once we are in a full-blown recession, it’s doubtful you’ll feel the need to ask about it.

The reality is that, if the U.S. is in a recession today, it has to be one of the best (least painful) recessions in history. Although the unofficial “official” indicator for a recession is back-to-back quarters of negative GDP growth — which we just experienced — it is hard to dismiss other economic indicators that are very “non-recession-ish.”

Industrial production is up and consumer spending has increased even after removing the effects of inflation.

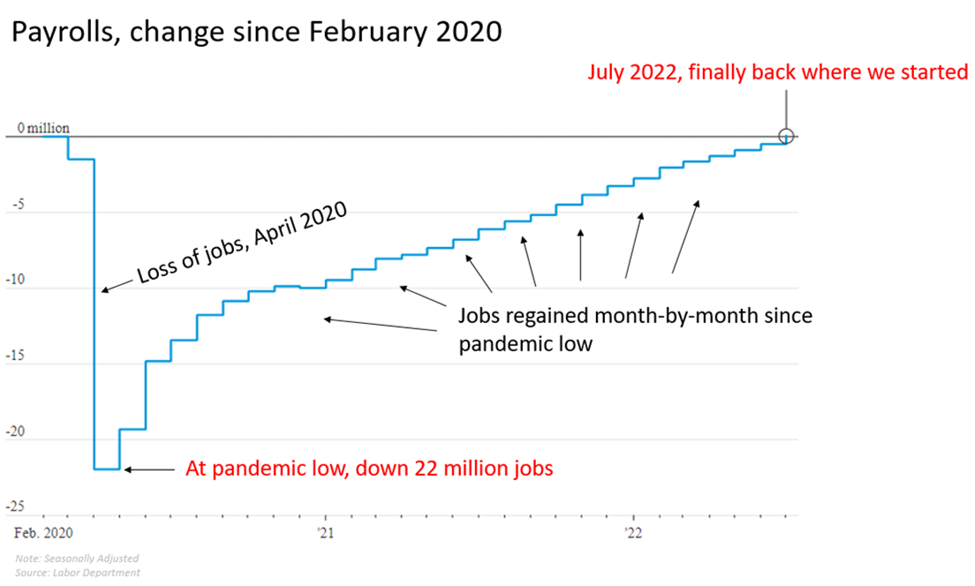

More importantly, the number of people with a job has increased pretty much every month since the start of the pandemic in spring 2020. In fact, as of July, we have finally regained the 22 million jobs lost in early 2020.

The unemployment rate just hit 3.5%, which is the very low rate we had right before the pandemic started, while Trump was still president. This is a half-century low, last seen during the Nixon Administration. If low unemployment is the pinnacle sign of economic success, might that suggest that Nixon, Trump, and Biden are three of the best presidents in the history of the United States?

All sarcasm aside, we view the recent GDP report as another omen of more trouble ahead. Add it to the growing list of warnings signs, along with the inverted yield curve, the sharp slowdown in the housing market, the increased use of credit cards, and the difficulties inflation poses to lower-income consumers.

In other news . . .

President Biden just passed into law what is now known as the “Inflation Reduction Act,” which we are not going to dissect in this Investment Commentary. It is a much-watered-down version of the original Build Back America Act and is not worth discussing here in detail. But there is an aspect of it that has us curious.

One of the Act’s provisions is directed at beefing up the IRS’s efficacy, hiring 87,000 new agents to audit more people, thereby collecting more taxes, thereby reducing government debt (allegedly). Have they not looked at the jobs market??

There are still 10.6 million unfilled jobs in America . . . and only 5.9 million Americans supposedly looking for work.

How many of those 5.9 million people are qualified to audit tax returns? We think it might be a challenge to hire 87 people who have a working knowledge and understanding of the U.S. tax code. Where’re they gonna find 87,000?

At BCWM, we expect the economy to soon be more challenging . . . in other words, a real recession. One where people lose their jobs and stop spending money, causing more people to lose their jobs. Our portfolios are positioned for this potential development. Bonds should perform well and value stocks should perform well relative to the rest of the market.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.