The United States Supreme Court recently heard arguments regarding the Patient Protection and Affordable Care Act… also known as Obamacare (you can read all 906 pages of it at http://www.gpo.gov/fdsys/pkg/BILLS-111hr3590enr/pdf/BILLS-111hr3590enr.pdf). At issue is whether it is constitutional to enact a law forcing every citizen to purchase health insurance… or pay a fine/tax/penalty if they don’t.

This is probably the most significant case to come before the Supreme Court since “Citizens United v. Federal Election Commission,” a decision handed down in early 2010. In Citizens United, the Supreme Court basically threw out years of campaign finance regulation by ruling that limiting corporate contributions to political campaigns violates the First Amendment right to free speech.

If you recall, shortly after that decision, President Obama used his State of the Union Address to verbally pistol whip the Supreme Court Justices who were sitting on the first two rows of the Senate Chamber. I happen to agree with the President that it is not healthy for billions of corporate dollars to influence elections. However, I’m pretty sure I wouldn’t trash the Supreme Court on national TV.

As the justices were debating the constitutional merits of Obamacare, the President took another swipe at them, calling them an “unelected group of people” who will have turned to “judicial activism” if they don’t affirm Obamacare. His comments came after a couple days of arguments in which it appeared the Supreme Court affirmation of Obamacare may not be a slam dunk. And if the Court rules against the health care mandate (calling it unconstitutional to force Americans to purchase health care insurance), the rest of the Obamacare bill will probably fall apart. One part of Obamacare requires insurance companies to accept new members regardless of pre-existing conditions. If insurance companies are required to accept people with pre-existing conditions, premiums for everyone would have to increase dramatically.

Calling the Justices an “unelected group of people” was a bit of hyperbole. Of course the Supreme Court Justices are “unelected.” One of the smartest things our founding fathers did was ensure that at least one of the three branches of the government would be somewhat shielded from the political process. Whether you agree with the Supreme Court or not, we are fortunate that we have a branch of government whose sole purpose is to uphold our country’s constitution.

But there is a lot at stake here. As I said last month (see Beware the Ides?), all Obama needs to get re-elected is for things to not turn ugly. The economy has ceased getting worse and the GOP is having difficulty finding direction, the perfect recipe for the Obama campaign.

The Supreme Court expects to announce their ruling on Obamacare in late June. That is one thing that could turn ugly for Obama… the one thing that could make him vulnerable. He spent the first year of his term focused on his vision of health care while virtually ignoring the worst economy in 80 years. The GOP already plans to make the economy a campaign issue (Obama: “the economy is getting better” … Romney: “it’s still horrible”). If the Supreme Court rules that Obamacare is unconstitutional, the Republicans will make that a MAJOR campaign issue (Obama: “the economy is getting better”… Romney: “it’s still horrible because you ignored it in order to pass a bill that was just ruled unconstitutional”).

Meanwhile, Santorum has dropped out of the race for the GOP nomination. Although Gingrich and Paul are still officially campaigning, Romney will win the GOP nomination. Romney and Obama: I’m not sure there has been a presidential race in history with two candidates who are more out of touch with the average American.

(Non-sequitur)

I was on six separate flights on three different major carriers in the past 10 days, and on every flight, the flight attendants made the same announcement: “This is a non-smoking flight.” Really? They still have to tell us that? If they don’t announce it, is there going to be someone on the flight who thinks, “hmmm, they didn’t say we couldn’t light up so… ”

How long has it been since there was a “smoking flight”? There is an entire generation of young adults who can’t even believe that smoking was EVER allowed in a sealed tube with a couple hundred other people. That generation must wonder what our generation was thinking when we decided it was OK to smoke on an airplane. Of course, possibly adding to someone’s confusion… on one of my flights the inside of the lavatory door had a pull out ashtray. I thought to myself, “how old is this aircraft?”

I’m curious how many years need to pass before the airline industry decides it doesn’t need to make the “no smoking” announcement anymore without fear of someone “lighting up.”

By the way, every flight was full… completely full… and it wasn’t spring break. Either the economy is improving or the airlines have cut back the volume of flights. My bet is the latter. Either way, I didn’t get excited thinking maybe I was detecting an investment opportunity. We tend to avoid investing in airline stocks. It is generally a bad idea to invest in companies who have minimal control over their destiny. Between terrorist attacks and unpredictable fuel prices, quantifying the value of an airline is just guessing and hoping.

(Back to the Markets)

In March, the stock markets continued their slow, steady climb, the S&P 500 posting a gain of 3.29%. It has gained 12.58% since the end of 2011 and over 25% in the past six months. Also significant, up until this past week, markets have continued to exhibit very little volatility (see Beware the Ides?).

A few reasons for optimism:

U.S.car sales in March were at their highest level since February, 2008. (One of those headlines that sounds good on the surface… however, many headlines look good compared to 2008. When you compare something to 2008, you’re probably reaching. It’s good to know the patient is not dead but disappointing to learn he is not well enough to leave the hospital).

Initial unemployment claims in the U.S.are near a 4-year low (this doesn’t mean things are better, just that they have ceased getting worse. It doesn’t mean employers are hiring… it just means they have stopped firing… as much).

Retail sales increased 1.1% in February after a more modest increase in January.

Occupy Wall Street has virtually disappeared.

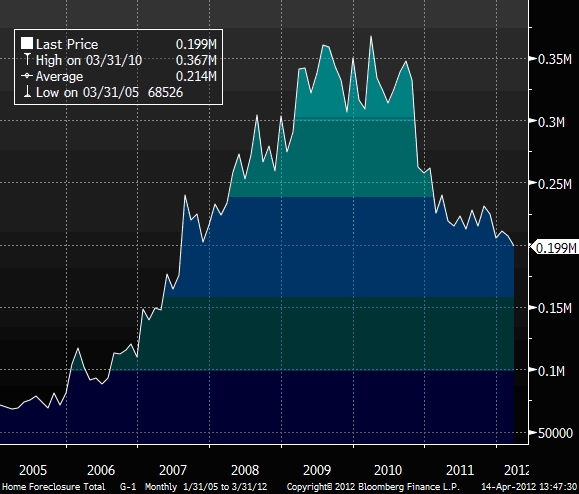

Below is a graph which I have included from time to time.

This shows the number of monthly new foreclosure filings going back to the end of 2004. Throughout 2009 and 2010, there were between 300,000 and 350,000 new foreclosure filings each month (about 4 million each year). Last month, there were just under 199,000—the first time it has been below 200,000 since July, 2007. The good news? It is clearly getting better. The bad news? The number of new foreclosure filings is still more than triple the rate prior to the economic collapse… and the rate of improvement seems to be slowing this past year. It is almost three years since the recession officially ended and we are still averaging over 2 million new foreclosures per year.

There have been some slight improvements in housing statistics recently, many of which can be attributed to unseasonably warm weather… not an unseasonably warm economy. Two million new foreclosures per year combined with higher fuel prices tell me that growth in the U.S.is going to continue to be slow and frustrating.

Meanwhile Europe, which had been very quiet for several months, is starting to make noise again. The interest rate onSpain’s 10-year bond has climbed above 6% after being under 5% just two months ago. It was only a few months ago that the European Central Bank provided €1 trillion to European banks through the long-term refinancing operation (LTRO). €1 trillion is apparently not what it used to be.

At Boyer & Corporon Wealth Management, we have slightly reduced our equity exposure. A 25% increase in six months was enough to encourage us to take some profits. Corporate balance sheets are flush with cash, making corporate bonds an attractive alternative. Municipal bonds staged a nice rally in the first quarter and still represent attractive relative returns.

I will be attending two conferences the first week in May. The Annual Strategic Investment Conference will be in San Diego May 2-4 and the list of speakers includes some of the most pessimistic minds in the industry. Pre-conference literature cautions against bringing razor blades. The second conference is May 5-8 in Chicago. It is the 64th annual Chartered Financial Analysts Conference, which I attend every year. I’m sure both conferences will provide enlightening material for my May Investment Commentary.

I will be tweeting from both conferences. You can follow me @boyercorporon.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.