Last week we conducted a webinar for private clients of BCWM where we recapped last year, the worst year in recent history. Not the worst year for investments . . . just the worst year.

We reflected back to January 2020, when headlines began warning of a new virus originating in Wuhan, China (and how surprised we were to learn that there is of a city of 11 million people we had never even heard of).

The Super Bowl was played as scheduled on February 2 (Go Chiefs!), but after that things began to go downhill quickly.

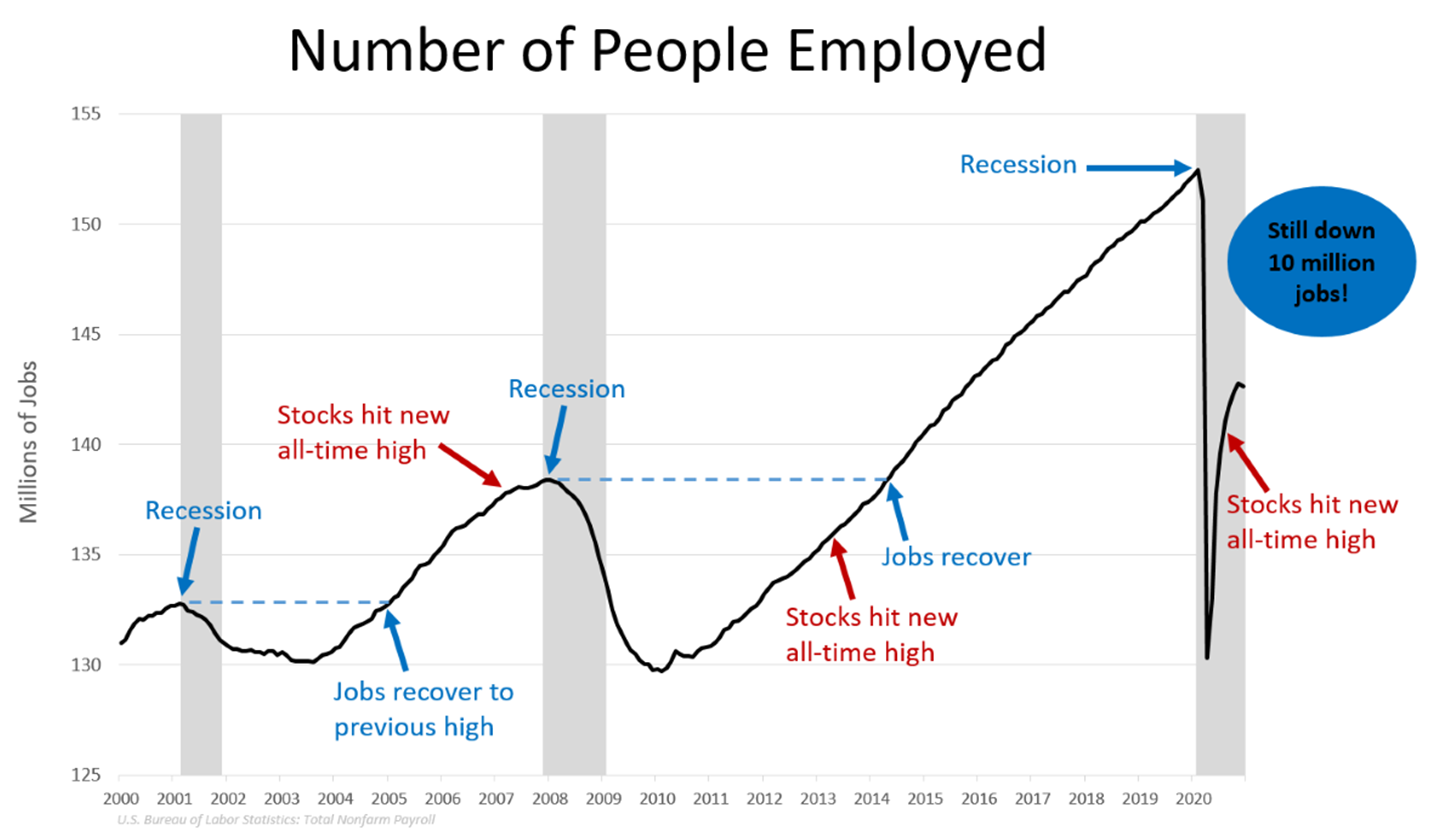

This virus took an economy that had been on a roll and steered it into the fastest recession on record. Twenty million jobs were lost virtually overnight. The stock market also took a dive, falling 34% for five weeks, from February 19 to March 23. It was a brutal time, with more fear and uncertainty than most of us had ever been exposed.

At BCWM, we managed to keep our wits about us. We remembered that the stock market is seldom a reflection of what is happening around us but instead a reflection of what is probably going to happen around us. We had to ask ourselves, “Can it really get much worse than this?”

As the public began to undergo various forms of quarantine, as small businesses went out of business (many permanently), as toilet paper mysteriously disappeared, as schools began to close and students gathered in virtual classrooms, we saw riots and looting and the most contentious election year of our lifetime. Through all this, we continued to do our best to try to peer into the future . . . to determine if this was a gigantic permanent change to life as we knew it or if this was a temporary economic inconvenience.

We chose the latter . . . that, from a financial standpoint, it was an economic inconvenience. The market agreed, and from the bottom, it climbed 70% to end the year at record levels.

So where do we go from here? Can the market continue its incredible run in 2021 or is it overdue for a correction?

In our webinar, we laid out a few reasons to be worried (and bearish on the stock market) as well as reasons to stay invested (and bullish):

Bearish Argument #1: The stock market recovery is outpacing the economic recovery.

The stock market is hitting all-time highs, while the economy is still climbing out of a pandemic-sized hole. The unprecedented loss of jobs was met with an unprecedented recovery, but we are still missing ten million jobs from the start of the recession! And yet, the stock market is so forward-looking that it has already fully recovered and then some.

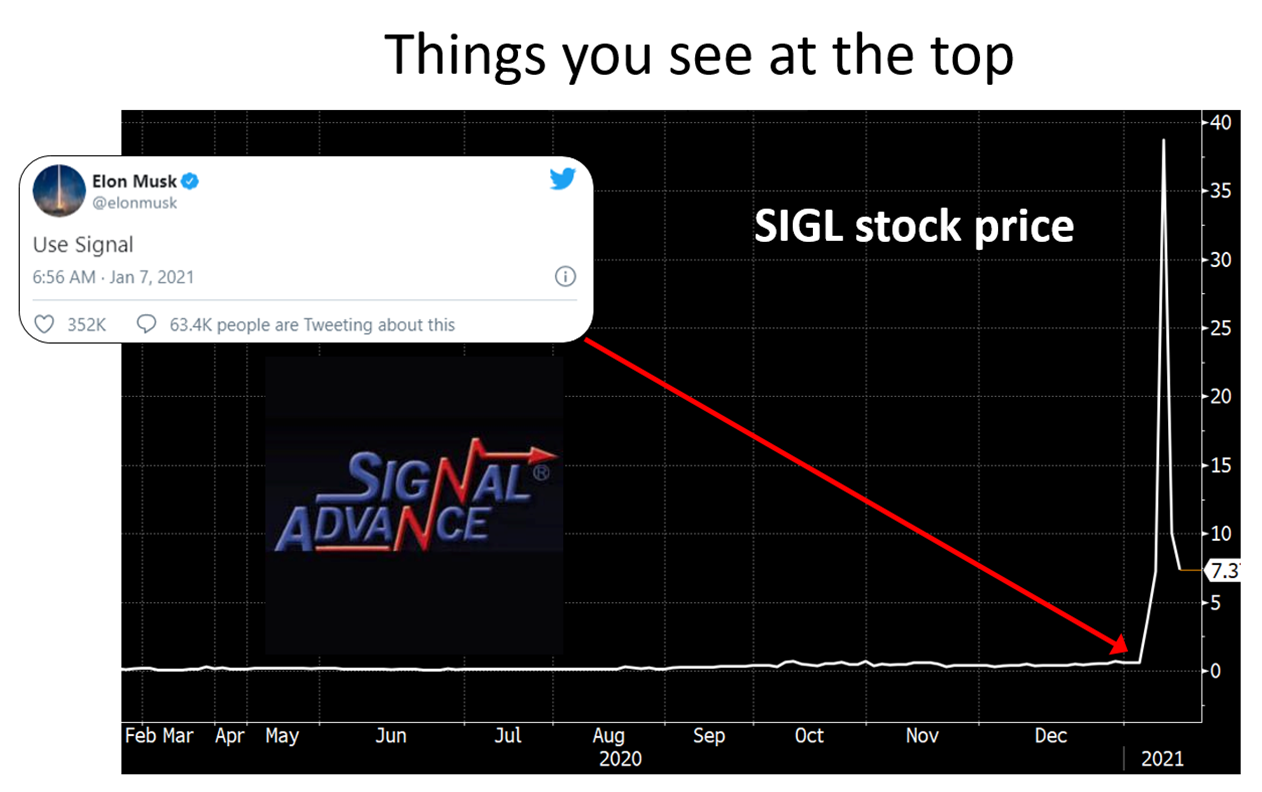

Bearish Argument #2: Nutty behavior is often seen at market tops.

Recently, Elon Musk sent a tweet that simply said, “Use Signal.”

Was he mad about a bad driver in front of him? No. Come to find out, he was recommending people use a messaging app called “Signal” instead of Facebook’s “WhatsApp.” However, minutes after his tweet and over the ensuing days, investors piled into an obscure penny stock with a similar name, “Signal Advance” (SIGL). This company, completely unaffiliated with Musk’s tweet, saw its stock price rise 5,000% for no other reason than its similar-sounding name.

You can see this type of speculative behavior throughout the market. Just look at the recent run-up in the price of Bitcoin.

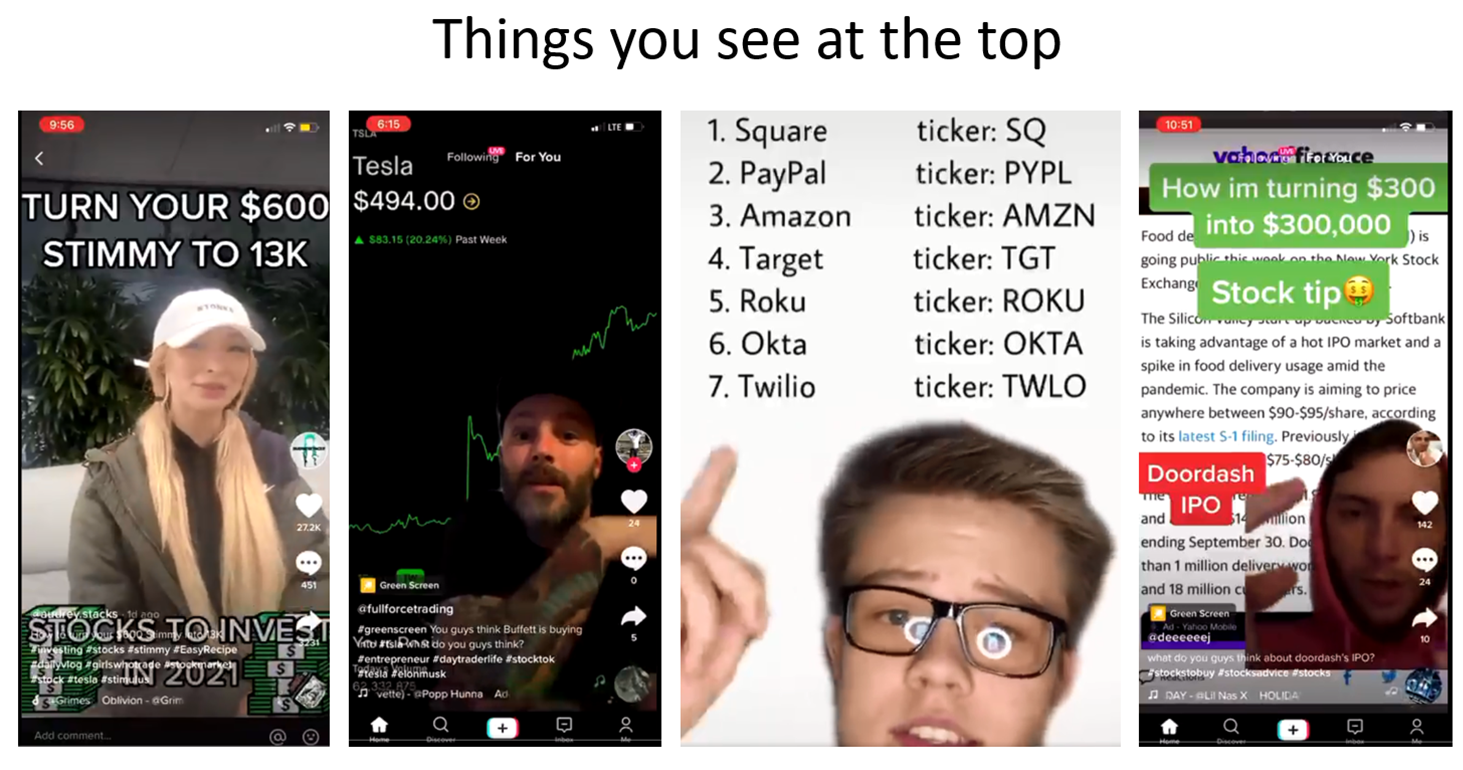

Or, better yet, log into the social media platform TikTok and go down the rabbit hole of self-appointed “investment experts” showing you how to get rich quick à la the dotcom era.

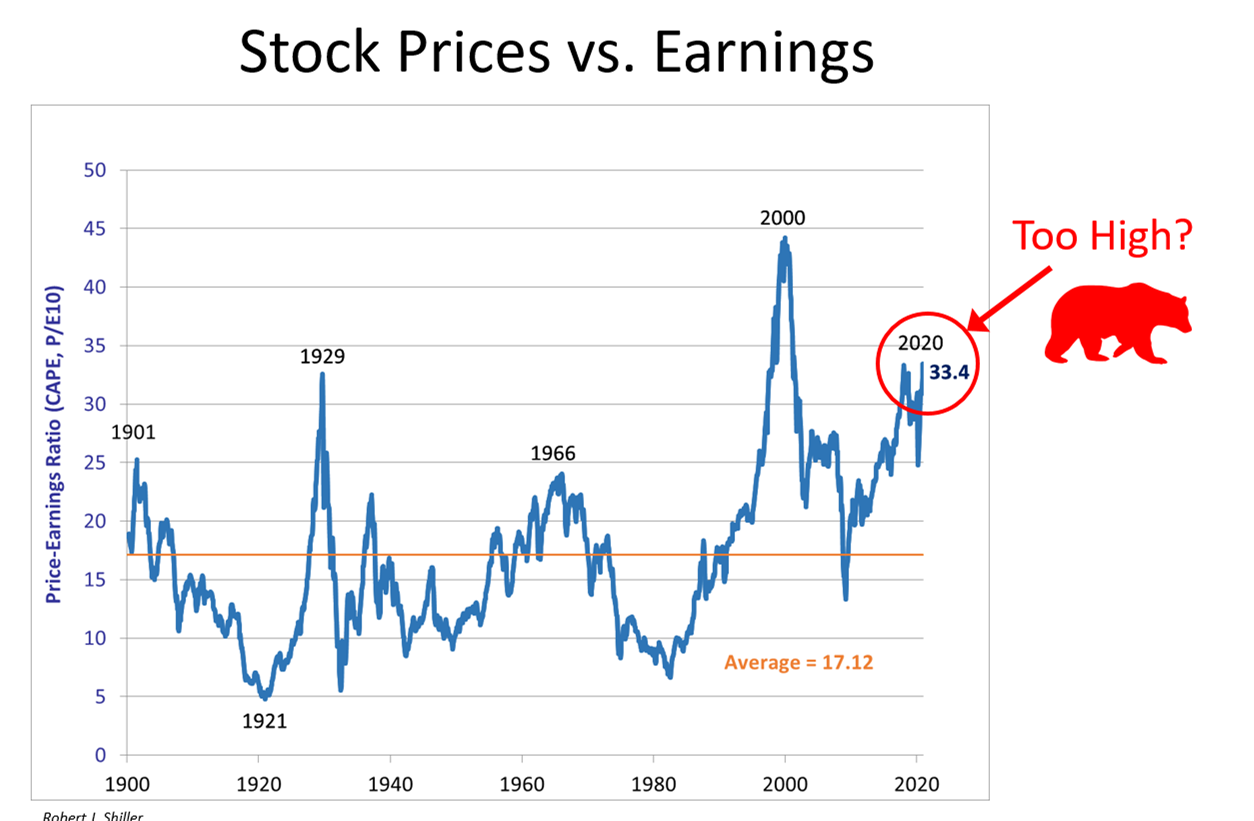

Bearish Argument #3: The stock market is overvalued.

This is undeniable if you believe that a fair price to pay for a company should be something relative to that company’s earnings. Currently, the stock market is trading at levels equal to 33 times its earnings. The historical average is closer to 17 times. Almost double!

But the market almost always seems to be expensive and we seem to frequently see nutty investment behavior. That being so, can the stock market actually increase even more?

Bullish Argument #1: Stocks can stay expensive for long periods of time.

For most of the last thirty years, believe it or not, the S&P 500 has been trading above its historical average.

Bullish Argument #2: There is no alternative.

One major reason stocks have been able to maintain such high valuations is because interest rates have done nothing but come down for the past forty years. As the rate of return you can achieve “risk free” declines, your propensity to invest in risky assets (stocks) increases, thus leading to elevated valuations.

For instance, the 10-year U.S. Treasury bond is trading today with a yield of 1.10%. Meanwhile, the expected earnings yield on the S&P 500 is a little over 4%. That’s 3% more of a reason to own stocks than Treasuries.

And as we’ve said time and time again, we don’t anticipate rates are going to be rising much higher for a long while.

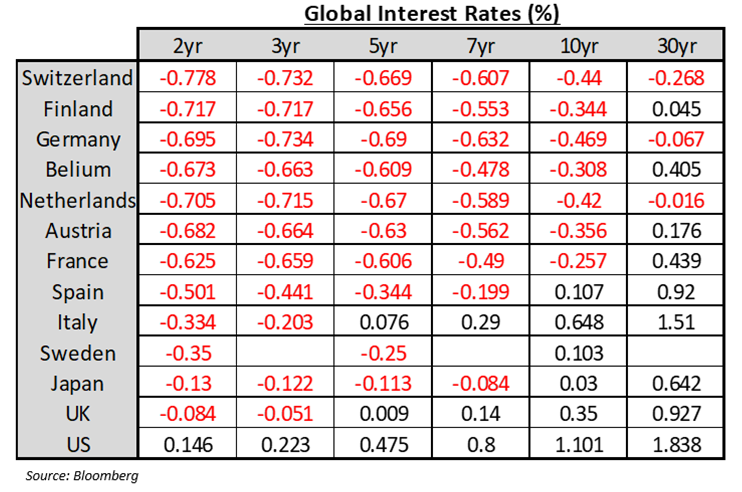

If you believe you can go overseas to get better yield, think again. There are twelve other major developed nations whose bonds are trading with negative interest rates.

By comparison, the United States bond market appears attractive. Where else are you supposed to invest but in risky assets if you want to generate any return whatsoever?

Bullish Argument #3: STIMULUS.

This is the biggest reason 2021 could be a good year for stocks and other risky assets. MONEY, MONEY, MONEY! Spending fuels our economy, and to pull through this recession quickly will require spending of unparalleled proportions. Future generations be damned!

We’ve already seen over $3 trillion in stimulus efforts thrown at the pandemic by the Treasury, and we can expect trillions more throughout 2021 as the Democratic government takes over.

This is why 2021 (especially the latter half) could be very good for stocks. Stimulus is making its way directly to consumers as we speak, and consumers are responsible for 70% of the growth in the U.S. economy. The average U.S. consumer is flush with cash right now, with money burning a hole in their pocket. As soon as the economy starts to really “open up,” we should see a spending spree like no other.

Summary:

It is almost universally accepted that the market is relatively expensive right now. However, there are forces at play that can artificially prop up the market for long periods of time. It is not our job to time the market.

It is our job to ensure we are invested with an eye to the future, appropriately diversified to provide you with stable long-term growth in your portfolio such that you can live your life with peace of mind.

An eye to the future means understanding what is the future. We recognize that changes were already under way because of advances in digital technology, and that the pandemic accelerated those changes. And when the pandemic has run its course and people are no longer wearing face masks, in other words, when life has somewhat returned to what it was before the pandemic, we’ll find that some of those changes have become permanent. To name a few:

- People will still order groceries, meals, and merchandise online for delivery to their front door step. The pandemic made consumers andproducers realize how easy a process this can be. This will be permanent.

- Many people will still work from home and travel less for business. Five years ago this was not even possible. Recent advances in technology have made this feasible. At some level, this will be permanent.

- The slow change from the combustion engine to electric vehicles will continue and pick up momentum. Some day the gas station will go the way of the pay phone.

- Going to movie theaters will remain a less popular activity. Large high-definition TV’s and online streaming have made it simpler (and cheaper) to watch from home.

And for those of you who continue to worry about our country’s debt leading to inflation, we maintain that lower interest rates are more likely in the near term. Negative interest rates are a popular item all over the world. Large debts typically lead to slower economic growth, which typically leads to lower inflation (maybe deflation), which leads to lower interest rates.

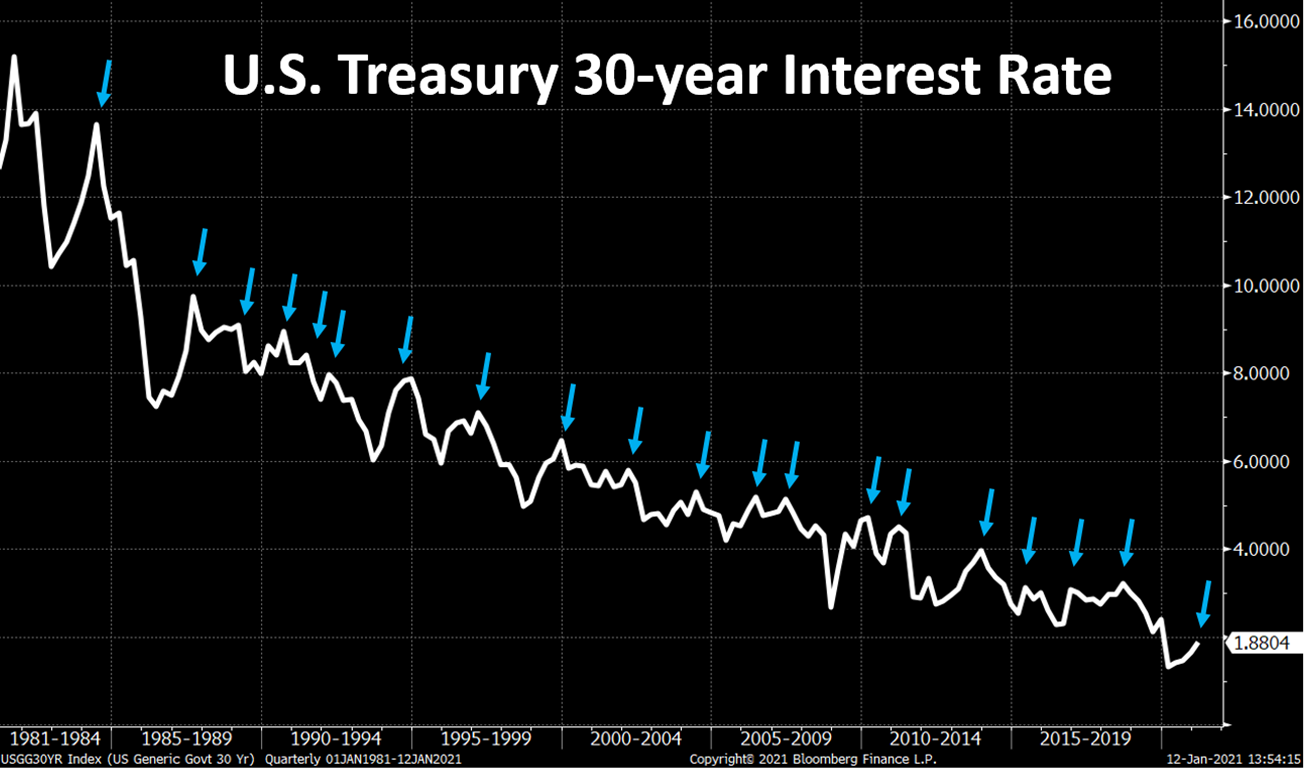

And in the last forty years, this is what has happened to the interest rate on the U.S. Treasury 30-year bond. You can see that recently the rate has increased . . . but after the previous nineteen increases over the past forty years, it always turned back down. We expect that to be the case again. It may go higher first! But ultimately it will go lower.

Bull or Bear, over the long term we will be in a better place. Human ingenuity is an amazing thing. Life on Earth should be better because of it.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.