When we published our Investment Commentary at the end of February, Russia had just invaded Ukraine. Since then, more than ten million people have fled their homes in Ukraine (a quarter of the country) and an unconfirmed number have died (likely in the thousands).

The Western world condemned the invasion and almost immediately instituted economic sanctions to cut Russia out of the world economy. More than 400 companies stopped doing business with Russia, by sanction or choice. It became impossible to conduct normal business in Russia. Moscow’s central bank struggled to support the ruble and the Russian stock market shut down for a month.

The unprecedented scope, size, and speed of divestment from such a large participant in the world economy is already reverberating through global financial markets.

When the planet is functioning relatively smoothly, as it has since the end of World War II . . . and even more so since the fall of the Soviet Union, most people don’t realize that Ukraine is the world’s #1 exporter of sunflower oil. Or that Russia and Ukraine together export more than 25% of the world’s wheat. Or that Europe is one of the largest consumers of energy supplied by Russia, both oil and natural gas.

These economic relationships become painfully disrupted during wartime. And the consequences, intended and unintended, will be immediate as well as long-lasting.

African and Asian countries rely on imports from Russia and Ukraine for most of their citizens’ food. Most reliant is Egypt, which was already experiencing a food security crisis before the war broke out.

As some parts of the world experience severe food shortages and famine, we would expect social unrest that could lead to governments being toppled. This happened in the “Arab Spring” of 2010–2012. In March 2011, we wrote about those events and how social media helped contribute to changes in power:

By the way, speaking of Africa and the Middle East, Facebook and Twitter did NOT cause revolutions in Tunisia and Egypt. However, without the new social media outlets, the revolutions might not have been as successful. Facebook and Twitter “revolutionized” the revolutionary experience…but they did not cause them. What caused governments in Tunisia and Egypt (soon Libya) to be toppled was the same thing that causes most revolutions . . . oppressive governments and unusually unhappy but organized citizens.

Facebook and Twitter helped them be more organized but the unhappiness? That came from 30–40-year dictatorships, skyrocketing food prices and 20%+ unemployment among the most youthful citizens. When 20+% of men between the ages of 17 and 30 are unemployed in ANY country (including the USA), you are going to have problems. Young men with nothing to do makes for an unhealthy environment.

In addition to food, Russia is a major exporter of many natural resources. Oil and natural gas are the headline grabbers, but the world will feel the shortage of other products such as nickel, palladium, platinum, steel, fertilizer, and more. These shortages will affect the cost of goods throughout the world, from cars to groceries and beyond.

Which leads us to . . .

____________________

It’s no secret that the cost of living has significantly increased this past year. Pandemic-induced supply-chain disruptions, combined with an unexpected war in Ukraine, have put the squeeze on supply, while demand has remained relatively unchanged.

And when demand exceeds supply, prices go up (what is known as inflation). For most people, the word inflation implies that prices will continue to increase . . . month after month . . . year after year. Like the ‘70s.

At BCWM, we disagree. The supply-chain disruptions are slowly getting better. And the war, while inevitably causing chaos throughout the world, will not go on indefinitely. We hope.

It’s hard not to believe that prices will just continue to go up and up and up. If you listen to business channels on TV, that’s pretty much all you hear. If you read the newspapers, that’s pretty much all you read. And if you are surfing the internet and social media? That’s even worse!

Our advice would be to cease all three activities and find a good outdoor hobby now that the weather is getting nicer.

Remember this: Everything you hear . . . everything you read . . . everything you know about the economy is public knowledge and it is already history. There is nothing of which you are aware that the rest of the country is not. All the information you possess is already factored into the price of securities, both stocks and bonds.

It is only future information, which we do not yet possess, that drives the prices of securities.

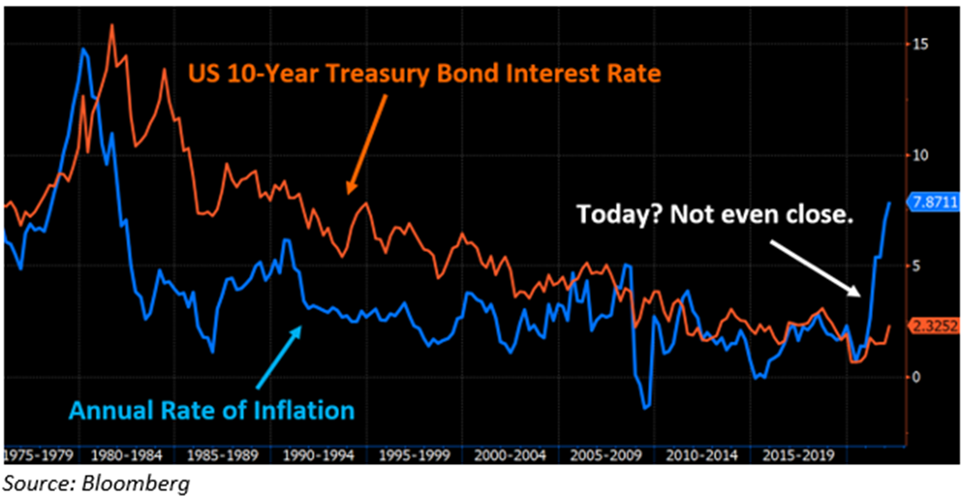

Throughout history, interest rates (which affect the prices of bonds) almost always exceed the rate of inflation.

For example, in January of 1980, when inflation was 13.9%, you could earn 14.1% in a 10-year Treasury Bond.

In November of 1990, when inflation was 6.3%, you could earn 7.6% in a 10-year Treasury Bond.

And pretty much all the years in between (and after), that relationship has held. Whatever the inflation rate, bonds are priced to yield just a tad bit more.

Today? Not even close.

“Inflation” the past twelve months has been in excess of 7%. But a 10-year Treasury Bond today is priced to yield only 2.35%? That’s backwards! Instead of earning a little over 1% above inflation, an investor actually loses over 4%.

The media may be telling you we are going to have inflation (indefinitely?), but the bond market is telling you that the quickly increasing prices we are seeing are short-lived (also called transitory).

And remember, if the higher prices don’t decline, that doesn’t mean we will have future inflation. Think about it. The cost of gasoline has skyrocketed recently, fueling (no pun intended) inflation . . . to an average of $4.70/gallon. If gasoline is still $4.70/gallon next March, the inflation rate was 0%. And if it’s selling for $4.00/gallon, we experienced DE-flation!

____________________

Although the U.S. stock market experienced a rough first two months of 2022 (down about 8%), since the Russian invasion of Ukraine, the stock market (S&P 500) has actually INCREASED about 4%.

At BCWM, we are not getting excited. We still feel that there are some disappointing future economic events that are not yet factored into the prices of securities (recession?). We remain cautious and defensive with a slightly higher allocation to cash than usual.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.