Most of our investors have a general idea of what we do. Manage money. Look for good investment opportunities. Avoid unnecessary risk. You know, the usual stuff.

Every now and then comes the opportunity to illustrate what we don’t do. If you have been paying attention (and believe us, it’s better if you haven’t been paying attention), there has emerged a new investment (using the word loosely) phenomenon.

The investment world used to be dominated by stockbrokers who gave spotty advice fraught with conflicts of interest leading to trades that were encumbered with large commissions. Ridiculously large commissions. Imagine calling a stockbroker today and paying a $200 commission to purchase $10,000 worth of stock . . . and then the same amount when you sold it. That stock had to appreciate 4% just for you to break even.

Eventually, competition forced brokerage firms to offer lower commissions on trades. They fell from $20 per trade (regardless of the size), then to $9.95, then $4.95, and eventually . . . $0. That’s right, ZERO! How can a brokerage firm make money if it charges zero, you ask? That’s an entirely different Investment Commentary and we won’t get into it here, but trust us, it still makes money. (And if they can still make money without charging commissions, imagine what a gold mine that USED to be.)

Not only has the cost of trading disappeared, but you can buy and sell stocks all by yourself on your computer or your mobile phone. You can be anywhere in the world (almost) and make a trade using an app from a dozen or more different brokers. You can be at a ballgame, in your office sitting at your desk, or even in the bathroom doing your business.

If you don’t have the financial wherewithal to hire someone like us to manage your wealth for you, then this might sound like an attractive alternative.

The elimination of trading costs, combined with the ease of making your own trades, has changed the way many people look at owning stocks. This has led to a phenomenon our Wall Street forefathers never envisioned. Young men (mostly young and mostly men) have gradually congregated over the past several years on an internet forum called Reddit. Under the topic “Wallstreetbets,” they have, en masse, targeted certain stocks to buy, thus driving up the prices of those stocks to levels that we have never seen in the past couple hundred years. It began to show up last year with trades for Hertz and Kodak.

It’s quite a bit more complicated than that and we try diligently to avoid tedious explanations about complicated investment events, but bear with us, because it’s actually pretty amazing/amusing.

Here we go . . .

The stock du jour is called GameStop (GME), a dinosaur of a business model that sells video games in shopping malls. They have over 5,500 stores in fourteen different countries.

The problem with GME is that, beginning several years ago, consumers could download games over the internet. Kind of a Blockbuster Video vs. Netflix type scenario. Not only did a trip to the mall for video games become unnecessary but, as of twelve months ago, trips to the mall for anything became problematic. And GME’s business model was in danger of going the way of the payphone.

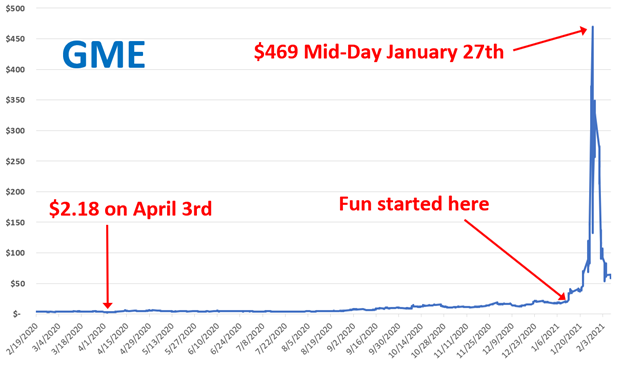

GME, which traded as high as $57 back in 2013, traded below $3 last April. And it was around $16 just a couple months ago. That’s when the fun started.

But to understand the fun, you need to understand the concept of “short-selling.” It’s really not that complicated but it’s a little backward from how investing typically works. Short-selling simply means you sell a stock first (because you think it is going to decline in value), with the promise that you are going to buy it back later . . . hopefully at a lower price. So, if you think GME’s business model is a dinosaur and that the company might ultimately be worth close to nothing, you might sell it (short) at $16, hoping to buy it back someday for $1 per share.

The fly in that ointment is that sometimes the stock price goes up instead of down. If you have to buy it back at a higher price, you lose money. Selling it at $16 and buying it back at $30 is EXACTLY as painful as buying it at $30 and selling it later at $16. Got it?

The scary fly in that ointment is that sometimes the stock price goes up so much that the short-sellers panic and buy back the stock before it goes even higher. The laws of supply and demand being what they are, short-sellers re-purchasing the shares drives the prices even higher again! This is known in our industry as a “short squeeze.”

Your average investor doesn’t “sell short.” At BCWM, we typically don’t sell short either. But some “hedge funds” who like to play in that arena ferret out what they think are dying businesses and take a short position in those companies’ stocks.

Here’s some irony. Companies with dubious financial futures (like GME) tend to attract more short-sellers . . . which, in turn, drives the stock price down. However, since short-sellers eventually have to re-purchase those shares, they represent potential buyers that would eventually make the stock price go up.

The quantity of shares that are sold short is called “short interest.” The larger the short interest, the more bearish investors are on that company. But that also means there are a lot more potential buyers.

GME had tons of short interest. Lots of big bets that the only direction this stock could ultimately go was down. But in mid-January GME started inching its way up. The WallStreetBets crowd on Reddit, noting the bloated short interest, began to rally around GME. And then it occurred to some of them that if they could drive the price up enough, the short-sellers would panic and drive it higher.

The second week of January it hit $39. On the 21st, GME closed at $43 and began an unprecedented meteoric rise. The closing prices for the next nine days were as follows:

Friday: $65

Monday: $76

Tuesday: $147

Wednesday: $347 (and on this day it traded as high as $469!!!) ← Also known as “the short squeeze”

Thursday: $193

Friday: $325

Monday: $225

Tuesday: $90

Wednesday: $93

Thursday: $53

From $16 to $469 — a 2,831% return in less than two weeks.

From $469 to $53 — an 88% loss in six trading days. OUCH!

Once you understand what the Wallstreetbets crowd did, the obvious next question is why? Why did a bunch of people organize online to temporarily pump up the stock price of a dying company? The short answer . . . They did it for fun and out of spite! Not only is it “funny” to jack up the price of dying companies, but the heavy short interest meant that there was a better chance they could knock out a few hedge funds in the process. One hedge fund in particular lost billions! The pandemic has left people with limited entertainment options and apparently this was better than binge-watching Netflix.

We’re not saying that what the Wallstreetbets group did was “smart,” but they certainly knew enough to be dangerous. And a lot of them probably knew from the beginning that they could lose a lot of money. However, it seems that this movement attracted many other, less-informed investors who did not fully comprehend the game that was being played. They saw the price of GME skyrocketing and FOMO (fear of missing out) kicked in. They purchased shares of GME and the frenzy continued. Until it all came crashing down. (As of this writing, it’s trading at $48).

When the dust settles, we expect this story ends with a handful of investors who made a fortune, a few disgruntled hedge funds, and a whole swath of people who lost beaucoup bucks in one of the most bizarre episodes to ever occur in the stock market.

There are a few other stocks that have been popular with the Wallstreetbets crowd. These three are having their own financial issues for one reason or another, so each of their stock prices was relatively low and their short interest was high. But then Wallstreetbets got hold of them and just like that . . . !

AMC Entertainment: 1,000% gain in 22 days — down 64% the next week

BlackBerry: 281% gain in 23 days — down 51% the next week

Bed, Bath and Beyond: 197% gain in 27 days — down 49% the next week

(On a side note: We’re not surprised Blackberry was trading at $7 per share. Haven’t heard much from them in a while.)

Why did we tell you all this? Two reasons. The first reason is that everyone has been asking us, “What the heck is going on with that GameStop stock?”

The second reason is in the title of this month’s Investment Commentary, “What We Don’t Do.” What we don’t do is gamble our clients’ assets in what has become the latest social media trend. At the very top of our website’s home page it says in big letters “Providing Peace of Mind.”

At BCWM we may not get everything right, but for every action we take, we ask ourselves, “Will this provide peace of mind?”

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.