The first eleven months of 2020 have been some of the most memorable months on record . . . and we hope to never remember them again. December, by comparison, has been rather mundane and somewhat boring so far in terms of financial news.

While the COVID infection numbers continue to increase each day, the financial markets seem to be shrugging off that news and pricing in a brighter future, given that vaccines are right around the corner. The stock market is up about 1.50% the first two weeks of December.

The good news is that, until just recently, the job market had been steadily improving since April. However, the bad news is that the rate of improvement slowed dramatically in November. And although we expect the first half of 2021 to remain sluggish employment-wise, we are optimistic that the second half will show progress once vaccines allow economies to return to some version of normal.

But as we try to get a sense of where we’re headed, one area of interest is the U.S. consumer. After all, consumers really drive the American economy, so we like to check in on them from time to time.

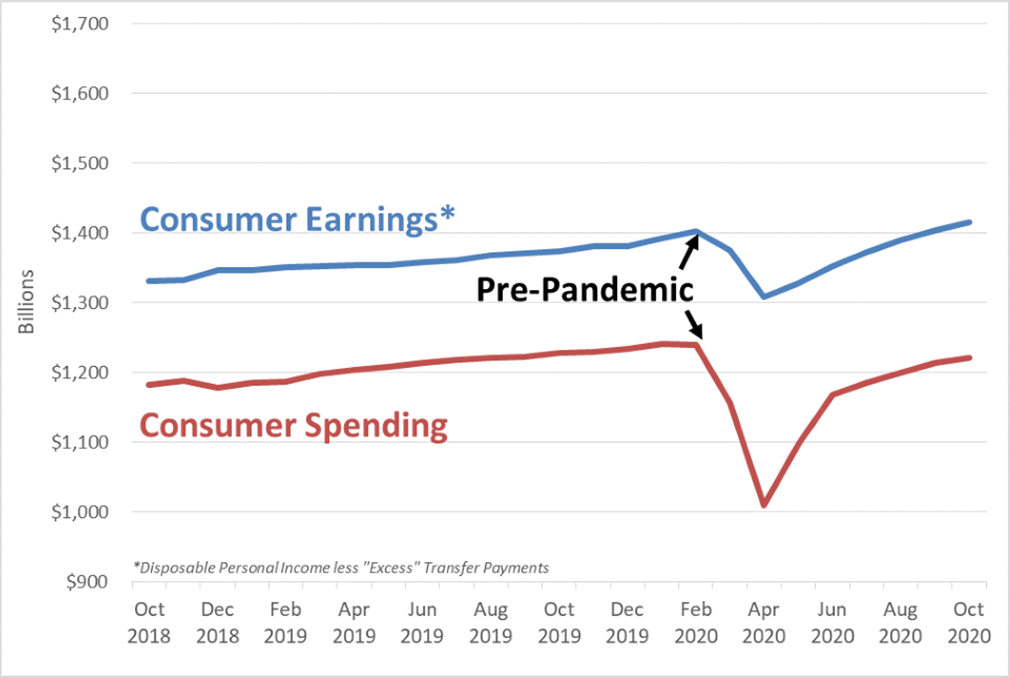

The chart below shows the total amount all consumers EARN each month (the blue line) and how much they SPEND (the red line). You can see that once the pandemic hit this spring and jobs were lost, income went down. Naturally, this led consumers to tighten the purse strings and spending dropped as well. That dramatic drop in consumer spending was the driving force behind the worst economic quarter in U.S. history.

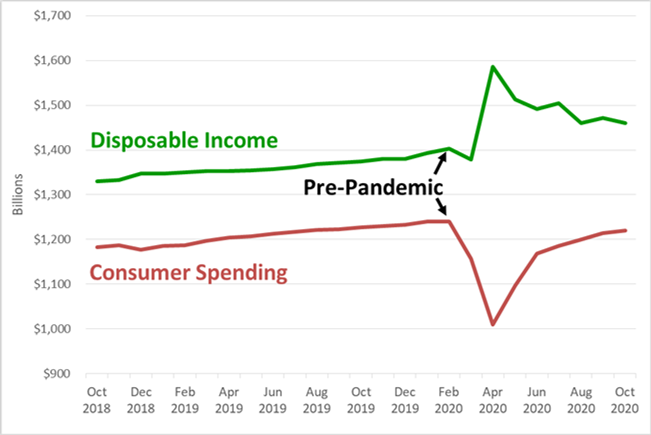

However, there is one big component missing. The blue line in the chart above excludes the extra cash the government doled out for disaster relief. When you include those extra dollars, true “Disposable Income” looks like this (green line below):

So what happened?! If pandemic relief funds were paid out and disposable income actually increased, why didn’t spending increase as well?

What the heck were people doing with the money if they weren’t spending it?

Oh, for sure, some of them spent it. But the average consumer did not. Although some people needed the extra funds just to make ends meet, those with the financial wherewithal either put the extra money in the bank or paid down debt.

And it’s our best guess that when consumers collectively get the “all clear” signal that the pandemic is somewhat over, it will unleash a spending spree. Those who paid down credit cards may pick up spending and run their credit card balances back to their previous levels (because that’s what they do, don’t they?), and those that kept the cash in their bank account will finally go out and spend it.

If this “shopping spree” level of spending were to be an annual phenomenon, we might begin to fear that inflation is around the corner. However, we’re guessing that this will be more of a one-time splurge. We actually suspect holiday spending might be surprisingly good simply because spenders probably have a little extra cash . . . cash that they normally would have spent the previous eight months on travel, dinners, and nights on the town.

On another consumer debt-related note . . .

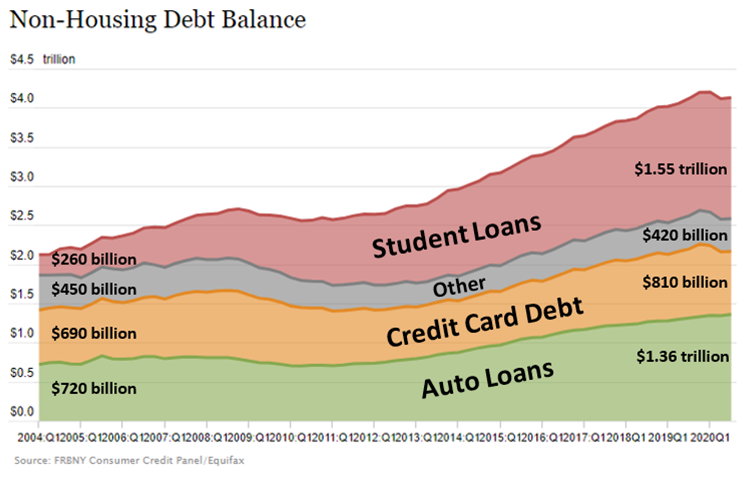

The amount of student loan debt in this country has become a staggering figure. We owe more in student loans than on auto loans or credit cards. The only area where Americans accumulate more debt is housing.

Even worse, for the last decade, 10% of student loan borrowers haven’t even been making their loan payments.

Some alarmists are calling the student loan situation a crisis. And perhaps it is for students who took out loans but never earned a degree. Or students who graduated but could not find work. But for some it is undoubtedly not a problem, such as the Yale Law School graduate with over $100,000 in student loans. Ironically, in dollar terms, most student debt is owed by upper-income households.

How did we get here? Why did student loans balloon to nearly 40% of all non-housing related debt?

Some blame the government-backed loan programs that began in the late 1960s, just as the Baby Boomer generation headed off to college. Eighteen-year-old high school graduates signed up in droves for loans that they figured they would eventually pay off, with very little concept of “cost vs. benefit.” (Let’s be fair, were any of us smart enough to make $100,000 decisions at the age of 18?)

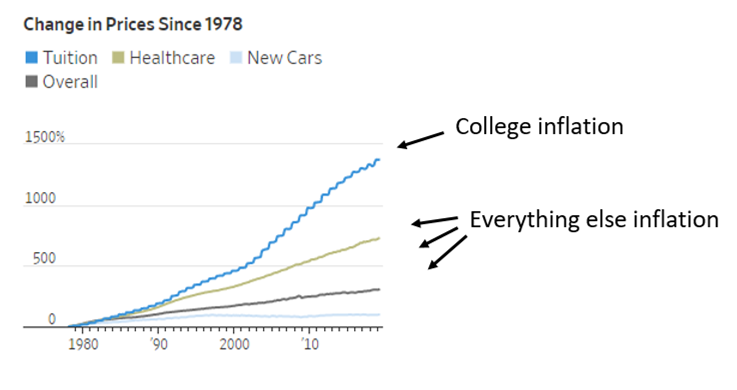

Easily obtainable student loans (sometimes for specious degrees that would lead to virtually no career of any financial significance) provided the opportunity for almost any person to enroll in college, thereby driving up the cost of secondary education at four times the rate of inflation.

If you recall, somewhat similar governmental behavior led to the mortgage crisis of 2008 and drove up the prices of homes. “Well-intentioned” government policies created perverse incentives to grant mortgages to borrowers who had no business taking on a mortgage of any size.

And just like the mortgage lenders who loaned $1 million to someone with a sub-500 credit score, the federal government handed out college loans like candy to summer school all-stars. Colleges could admit anyone they wanted and they weren’t penalized if students dropped out and defaulted on the loans.

What we are left with is students graduating today with $30,000 of student loan debt, on average. The worry, to some economists, is that a large proportion of our working population will be spending the next ten years paying down student debt instead of buying houses and cars and starting families. The kind of spending (mentioned earlier in this article) that drives our economy.

Why is this newsworthy now? Because President-elect Biden has made it clear that he plans to do something about the student loan debt problem. There has even been talk about outright cancellation of some student debt.

Can you imagine being the 30- or 40-something-year-old former student who has diligently paid off your student loan debt only to see millions of Americans have theirs forgiven? Does that mean you get a refund? The grads who paid off their student loans thirty years ago. Do they get a refund too?

What about the millions of people who never went to college? If you have established a quality career with your high school degree, isn’t it a little unfair that the person who ALREADY has a better shot at a higher paying career gets a big government check and you don’t? Wouldn’t this just widen the gap between the haves and the have-nots?

And if you are just beginning college today, should you ever even worry about ever having to pay for it?

There are many unintended consequences to cancelling student loan debt. And we agree that it is a problem and that there are NO easy answers. We are just happy we don’t have the job of sorting out this mess.

Here’s hoping you have a wonderful holiday season. Be sure to help the U.S. economy by spending a lot of money!

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.