We heard an interesting factoid the other day. But it was one of those moments where you’re somewhat listening and not really paying attention.

It said that the Japanese stock market had just hit a 31-year high, which sounds like a good thing. But then we thought, “the Japanese stock market is JUST NOW higher than it was 31 years ago?!! Where the heck has it been for the past three decades?”

Our older readers might remember the late ’80s, when Japanese investors were buying buildings in New York City, and we all thought Japan was going to become the largest economy in the world and the yen would replace the dollar as the reserve currency. (Sounds kind of like China today.)

So, what happened to Japan?

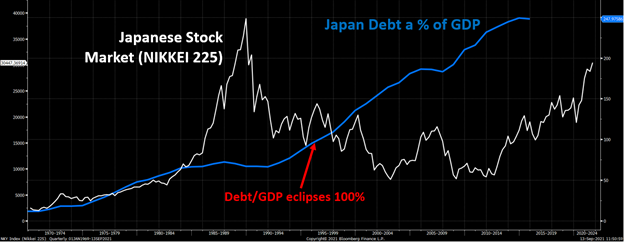

What happened to Japan back then is the same thing happening to the United States now. In the late 1980s, Japan had issued so much debt that the amount of it finally exceeded the country’s annual Gross Domestic Product (GDP). And then Japan continued to issue more debt . . . and more debt . . . to where it now equals about 250% of GDP.

Throughout history, it has been shown that excessive debt constrains economic growth. Since Japan’s debt eclipsed its GDP, Japan’s economy has had negative “net growth,” and the stock market moved sideways for 30 years.

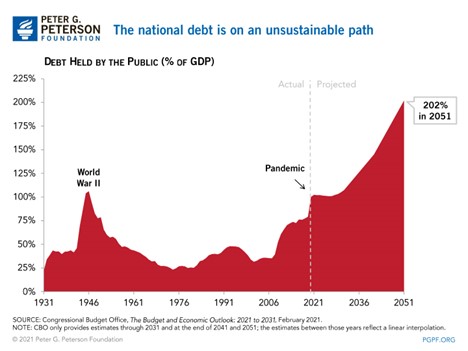

Why is this relevant? Because last year, thanks in part to COVID bailouts, our national debt exceeded 100% of GDP for the first time since the end of World War II. And the Congressional Budget Office projects that national debt could surpass 200% by 2051.

While the pandemic exacerbated our debt issues, we were, in fact, already on this fiscal trajectory thanks to the “structural mismatch” between spending and revenues (we spend more than we take in . . . and there’s no end in sight).

As our readers know, we have been expecting low interest rates for years. Generally, our argument is that high debt begets low economic growth, which begets low inflation, which ultimately begets low interest rates. Japan has been a near-perfect case study of this argument. If the U.S. debt load follows Japan’s model, it’s possible that the stock market will too. Investors who are banking on a forever bull-market will be dismayed if the S&P 500 hits a 31-year high in 2052.

With the power of hindsight, we can see that Japan’s stock market was a bubble ready to pop. Looking at the U.S. stock market today, plenty of metrics suggest stock valuations are too high, and we continue to read story after story about other “excesses” that rival previous stock market bubbles:

- People are spending hundreds of thousands, even millions, of dollars on digital pet rocks.

- A 12-year-old boy is on his way to making nearly half a million dollars this year from selling similar “digital assets” . . . clip art pictures of whales.

- Robinhood, a popular app for trading stocks (and other securities), recently revealed that 26% of its revenue comes from dogecoin trading commissions. A company that is worth $35 billion dollars makes a quarter of its money by facilitating trading of a digital asset that was created as a joke! Welcome to 2021.

If our stock market does follow Japan’s lead, these types of stories will have been obvious red flags. How is BCWM preparing for this potential future?

We are not dependent on a hot stock market continuing in perpetuity. We diversify our portfolios across every asset class – domestic stocks, foreign stocks, bonds, commodities, cash, etc.

Stocks carry risk, but it is not prudent to omit them entirely from our portfolios. Thus, we try to own stocks with steady dividends and dependable business models that trade at reasonable prices.

Bonds make up a significant chunk of the assets we manage. A future with low interest rates also brings low returns for the typical buy-and-hold bond-investing strategy. We maintain a sizeable position in bonds that will perform very well in a decreasing interest rate environment (long-maturity U.S. Treasury STRIPS).

Hot markets are great, but we care more about managing downside risk. Our aim is to only take on the risk that is necessary to help our clients reach their financial goals.

__________________________________________

This month marked the 20th anniversary of the terrorist attacks of 9/11. There are a handful of days in our lives that become indelibly etched. One of those days was the Kennedy assassination in November 1963.

We remember 9/11 as a beautiful Tuesday morning. Temperatures in the 70s for most of the country, and clear skies . . . that quickly became scary and not so beautiful. Our world came to a screeching halt for the remainder of that week as we all focused on the rescue mission taking place in New York City. Airports were closed, the stock market didn’t open until the following week, and we, as a nation, seemed more united than we can ever remember.

“More united than we can ever remember.” Sounds nice, doesn’t it?

Today, our country seems more polarized than we can ever remember. And you can blame whatever/whomever you want. The list of candidates is endless. In our opinion, the number one driver of polarization? Social media. Hands down.

And although we at BCWM are not longing for a national terrorist attack, we do long for the day when everyone remembers that the United States is still the best country in the history of the planet. With all its faults and shortcomings, each of us is still very lucky that serendipity selected each of us to be born here . . . or to have somehow ended up here.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.