In our Investment Commentary last month, Good News is Bad News, we illustrated how the dramatic drop in the stock market was instigated by ONE measly data point. Wage growth for the month of January ran a little higher than expected, stoking fears of inflation. We didn’t panic because we were not concerned (yet) that inflation is going to become a big problem. Turns out we were right not to panic, because not only has February seen slower wage growth, but the January number was revised down as well!

It’s important to note, nevertheless, the market’s propensity to react violently to such a tiny bit of economic information, thus illustrating just how sensitive this market is. Even though inflation hasn’t really taken off, we now have an idea of what we can expect if and when it does indeed pick up.

Our long-term view remains that inflation, low employment notwithstanding, is not going to be a perpetual problem. However, that doesn’t mean that from time to time we won’t see a higher price here or a higher wage there.

This year could prove to be a little more difficult than the past nine years, because there is virtually no doubt that short-term interest rates will continue to rise as the Fed increases the Fed Funds rate several times. That doesn’t mean stocks won’t be positive for the year, but there might be several more periods like early February that test investors’ mettle.

There are other reasons to be concerned about the stock market. One is that stock volatility has returned. Last month we included a graph showing the Volatility Index (VIX) for the past ten years. Even though recent volatility is nothing like what we saw during the Financial Crisis, it is still enough to get our attention. You can see that, even at this writing, the VIX hasn’t returned to the peaceful levels of the past couple of years. And this we know for sure: ultimately, markets don’t like volatility. Continued volatility will eventually lead to lower stock prices.

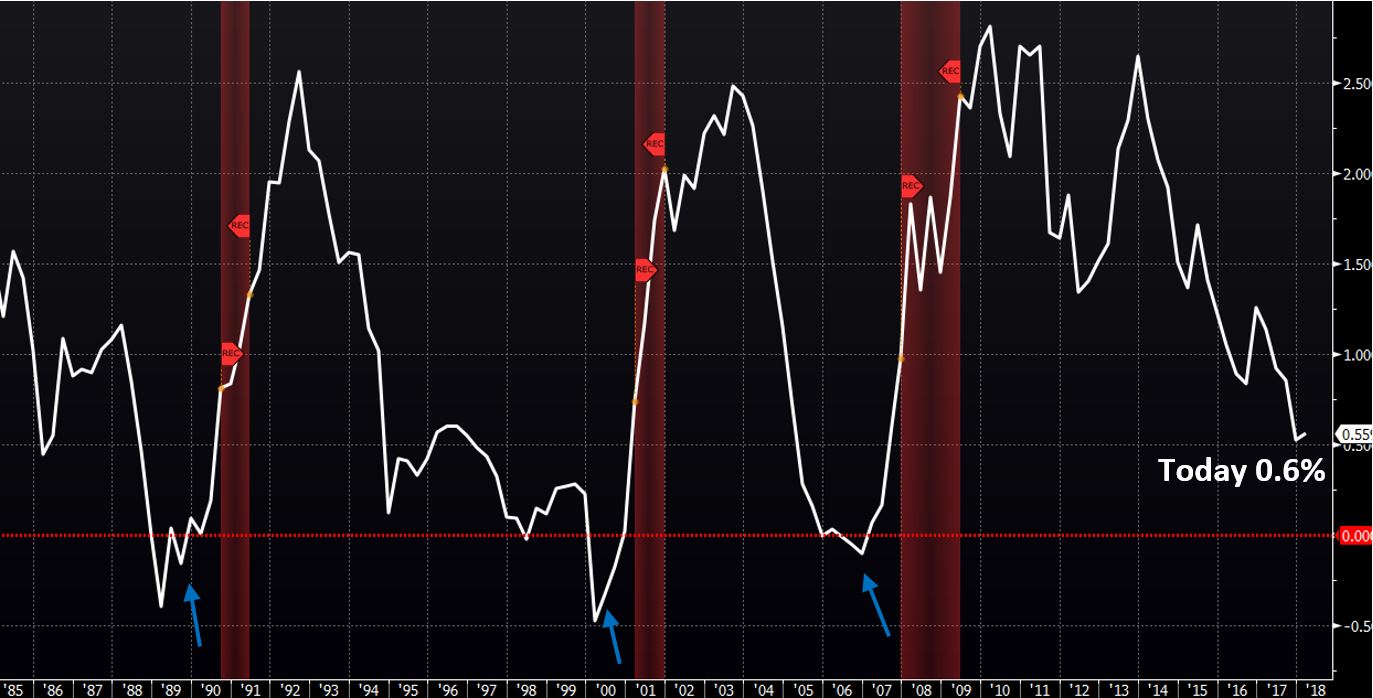

Also grabbing our attention is the shape of the U.S. Treasury “yield curve”—more specifically, the difference between short-term interest rates and long-term interest rates. In general, a bond that matures in 20-30 years should have a higher interest rate than a bond that matures in 10 years or less. That’s pretty much always the case. Typically, the difference between the two is more than 1%. Today, the 10-year interest rate is only 0.6% higher than the 2-year interest rate (2.8% vs. 2.2%), possibly heading toward zero. When long-term bonds yield less than short-term bonds, we are almost always headed toward an economic recession. And economic recessions beget lower stock prices.

The graph below tracks the difference between the 10-year and 2-year U.S. Treasury interest rates (white line) back to the 1980s. The blue arrows point to periods when the interest rate on long-term bonds was less than short-term bonds; economic recessions (shaded in red) followed shortly thereafter.

What is noteworthy is that the long rate dropped below the short rate prior to each of the past seven recessions.

A number of things can influence interest rates, but the level of short-term interest rates is heavily influenced by the Federal Reserve. We expect it could hike rates another 0.75% – 1.00% this year. If it does, and longer rates don’t adjust upward, it is likely that the line on the graph above will eclipse zero yet again, signaling a recession.

No indicator is foolproof. We continue to follow developments in the economy, and currently nothing scares us into thinking a recession is imminent, especially not after the recent historic tax cuts. We see more of the same slow, steady growth. But that does NOT mean markets won’t sell off. Remember, the stock market is not the economy.

We are not going to “cash out” our portfolios. As we noted in an article last month, market timing is a fool’s game. However, we will continue tactically reducing risk in the portfolios and stay diligent in security selection. Taking care to diversify and reduce risk where possible is more important than ever . . . and we want to be in a position to go shopping when things are cheap.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.