This article was written in March of 2021.

Inflation should be an important input into any financial plan. The average price of things generally increases over time. Thus, you need your money invested such that it grows to cover those higher costs.

Intuitively, we know that inflation happens. When I filled out my children’s baby books, I included the cost of items from when they were born (for example, a gallon of gas) so that when they’re older they can marvel at how much more expensive they are (although at that point the gas-powered vehicle will have gone the way of the pay phone).

But why do the costs of goods go up and down? What causes inflation and why is it important?

In Econ 101, you learn that price is a function of supply and demand. If something is in high demand, the market will generally bear higher prices. Case in point: Uber charges “surge” prices around dinner time on Friday night. Why? Because it can. Alternatively, if the supply of something is reduced, given no changes in demand, prices should increase.

In a growing economy, inflation ought to naturally occur. Higher production leads to an increase in employment. More people employed means more money in pockets, which leads to more demand, which leads to higher prices. And the world goes ’round and ’round.

In a well-functioning economy, inflation is stable and predictable (in the low single digits). This is a good thing. But it’s not that simple. Economies don’t go “up and to the right” linearly. There are shocks (man-made or otherwise) that cause sudden increases or decreases in supply or demand (something, perhaps, like a global pandemic forcing twenty million people out of work overnight).

That is where governments and central banks step in. If an economy needs help, the government can create policy, and central banks can deploy tools to help stimulate demand. Conversely, if an economy starts overheating, there are tools to try to slow it down. But those tools (such as raising short-term interest rates) can have damaging effects on the economy. It is a choice between two evils: slowing down the economy or risking runaway inflation. And runaway inflation is no bueno. If you don’t believe me, ask Venezuela, whose inflation rate reached 1,700,000% in 2018.

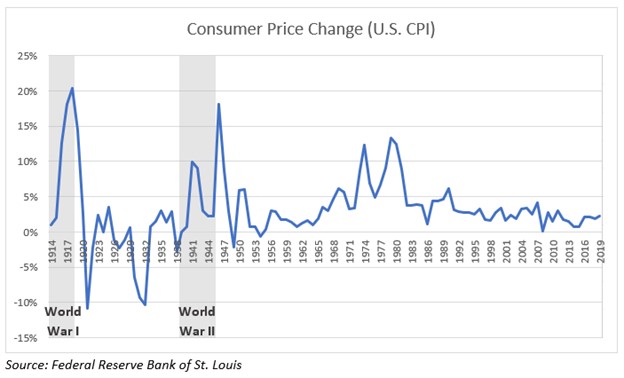

Thanks to the confidence in our fiscal and monetary authorities, the United States has been able to keep runaway inflation at bay. This includes steps taken by the Federal Reserve, as we noted in this month’s Investment Commentary. Since the introduction of the Consumer Price Index (CPI) in 1913 (a measure of the price of things we buy), the highest inflation rates observed were toward the ends of WWI and WWII. During wartime, governments are less worried about curbing inflation and are more focused on winning the war in front of them.

While the U.S. central bank has been able to help keep inflation fairly stable for the better part of forty years, there are those who believe that the sharp increase in government spending since the Great Financial Crisis — more recently exacerbated by the pandemic — is undermining the value of the dollar and will ultimately result in a sharp increase in inflation. The idea is that there are too many dollars chasing too few goods.

At BCWM, we are more concerned about the opposite. You don’t have to look further than Japan for an example as to why. Governments that carry large debt loads (U.S. Total Public Debt increased from ~$9 trillion in 2008 to ~$28 trillion today) have a hard time growing very quickly.

While spending and inflation may pick up in the short-term, the effect of massive government debt (all over the world) will be a slowdown in economic growth. And the effect of a decreased demand in goods and services is lower prices. We at BCWM are more fearful of deflation than inflation.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.