This piece really has nothing to do with how we manage investments for our clients, but we just can’t help writing about it. The investment world we live in today keeps getting more entertaining and just when you think you have seen every insane, stupid thing our stock markets can possibly offer, along comes something even more mind-boggling.

The stock price of AMC Entertainment, the movie theatre chain that was basically “out of business” for a large portion of 2020, was trading just over $2 per share as of the end of last year — a by-product of an iffy financial condition caused by the trend of home movie-streaming, which COVID helped to exacerbate.

Then, for whatever reason, the “Reddit” crowd (see “What we Don’t Do”) zeroed in on AMC, with its members rallying each other to buy AMC stock . . . and buy more AMC stock . . . and buy more AMC stock. Never mind that the company is in a struggling industry and was at $6 per share pre-COVID.

And on June 1, AMC shares traded as high as $32! Up over 1500% for the year.

That’s crazy, you say?

It gets crazier.

The next day, the CEO of AMC decided to get in on the action, announcing that shareholders of AMC are entitled to one free large popcorn.

The stock almost doubled in price that day, closing at $62! The value of the company increased by over $15 billion!!

One free large popcorn? Who woulda thought?

While other companies are working hard to increase revenues and hold down expenses, thereby creating shareholder value, all they really need to do is offer free popcorn.

(Fun fact: the world headquarters of AMC Entertainment is an eleven-minute drive from the world headquarters of BCWM . . . right here in Kansas City.)

__________________________________________

As you are aware from previous Investment Commentaries, we are not big fans of cryptocurrencies and don’t expect to be putting Bitcoin in our investment accounts any time soon.

Bitcoin was valued as high as $63,000 on April 15 and dropped to around $33,000 last week. Its meteoric rise notwithstanding, we try to avoid investments that can lose half their value in less than two months.

With that large of a drop, you might think now is the time to rush in and “buy the dip,” (it’s currently trading for ~$38,500). But our opinion has not changed. We conduct a fair amount of research on Bitcoin and other “cryptos,” trying to understand what they are, what they could be, and if we should consider investing in this area. And our research keeps turning up the same thing: it is an absurdly speculative asset class and too many fundamental problems stand in the way of crypto living up to the hype.

Still, cryptocurrency has a total market valuation of a couple trillion dollars. That is simply too big to ignore. And when you start to dig into crypto, it becomes very easy to be skeptical.

Like just a couple weeks ago, when the largest Bitcoin event in the world was held in Miami, FL. A couple of videos surfaced of one presenter who was very, let’s say, enthusiastic, about Bitcoin. He can be seen screaming expletives and ripping up paper money. In one tirade he shouts, “He who has the Bitcoin makes the laws.” Crazy.

Also at the conference, the president of El Salvador announced that his country would make Bitcoin its legal tender, becoming the first country to do so. Kind of wild to think a country is ditching its currency for crypto, but El Salvador never had its own currency in the first place. It uses the US Dollar.

About a quarter of El Salvadorans live in the United States, and El Salavdor’s economy depends on those citizens sending money back home to family. The idea is that Bitcoin can help facilitate these transactions. After all, global transfers of money is one of the biggest strengths of Bitcoin. There are reasons to be worried. El Salvador is one of the poorest and most dangerous countries in the western hemisphere, and the last thing it needs is a currency that can appreciate/depreciate so unpredictably.

Bitcoin’s ability to transfer money around the world is also an Achilles heel. Regulators are starting to pay closer attention to how much it enables cybercriminal activity. Bitcoin is practically the whole reason we have ransomware, a specific type of cyberattack where the victim’s computer is locked down until a ransom is paid. How would someone go about paying an anonymous hacker in cyberspace? With Bitcoin, of course.

Recently, there have been a few high-profile ransomware cases. In May, the operator of the Colonial Pipeline, a critical source of almost half of the fuel consumed on the East Coast, was hacked and forced to pay a ransom of 75 Bitcoins ($4.4 million at the time) to get back up and running.

Fortunately, last week the FBI announced that it was able to recover and return about 64 Bitcoins to the company. The hackers are still at large and will likely not be brought to justice, but this FBI bust highlights two important obstacles to Bitcoin’s widespread adoption.

First, the obvious: the FBI took the money back! Perhaps the most prominent belief of the crypto advocates is that it can circumvent government oversight. Not this time. Maybe these highly intelligent cybercriminals did not know how to cover their tracks and safeguard their bounty. Or maybe Bitcoin cannot completely escape oversight after all. And if the FBI can take Bitcoin from the bad guys, does that mean other bad guys could take Bitcoin from you?

Second, Colonial Pipeline still effectively paid a ransom! Yes, they got back nearly all of their Bitcoins, but by the time the FBI retrieved this “money,” it had dropped in value by nearly 40%. Colonial lost about $2 million when all was said and done.

__________________________________________

The unemployment rate, which was 3.5% pre-COVID and 14.8% at its worst during the lockdowns, clocked in at 5.8% for May. The majority of the nation has re-opened. Hotels are filling up, gasoline demand is back (oil is over $70/barrel) and the restaurants that survived 2020 are packed. Consumer spending, the engine that drives the U.S. economy, has returned.

This tremendous recovery is primarily thanks to Uncle Sam. Trillions of dollars in stimulus has put the average U.S. consumer in a fairly healthy financial position. Now, after receiving three rounds of direct stimulus checks in under a year, the economy’s training wheels are beginning to come off.

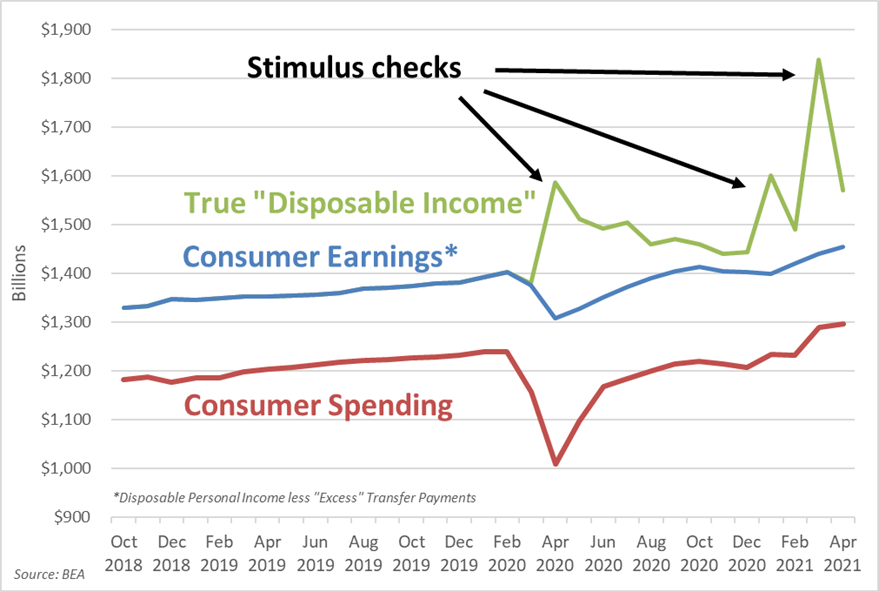

Check out this graph, which we first showed you in our December commentary, “Where’s the Money”:

It shows the total amount all consumers earn each month (the blue line) vs. the amount they spend (the red line). But the kicker is the green line, which shows true disposable income, because it takes into account all the extra stimulus payments the government doled out.

Those extra checks are going away. The blue and the green lines should converge by the end of this year. Now the question is whether consumer spending can maintain its momentum and lead to sustainable economic growth or whether it will sputter out. Who knows, maybe free popcorn will save the day.

At BCWM, we believe we will start seeing the economy slow down in the second half of this year. Structural disinflationary forces that were in place before the pandemic haven’t disappeared because of stimulus payments.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.